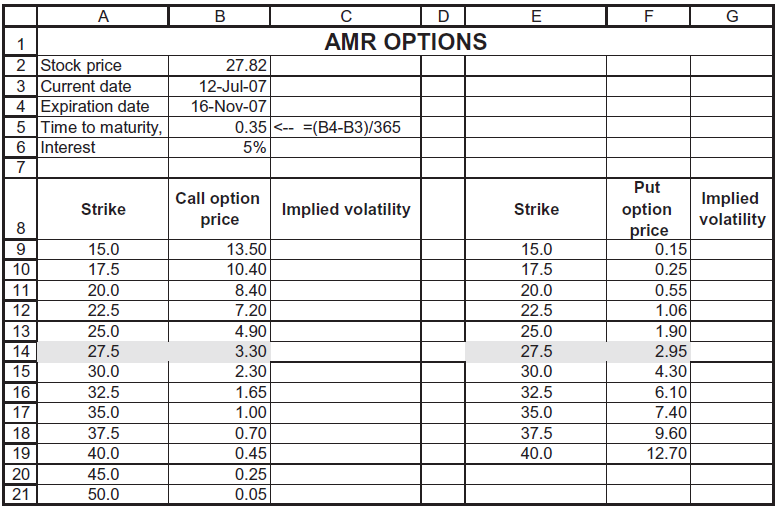

The table below gives prices for American Airlines (AMR) options on 12 July 2007. The option with

Question:

The table below gives prices for American Airlines (AMR) options on 12 July 2007. The option with exercise price X = $27.50 is assumed to be the at-the-money option.

a. Compute the implied volatility of each option (use the functions CallVolatility and PutVolatility defined in the chapter).

b. Graph these volatilities. Is there a volatility ?smile??

D AMR OPTIONS A В E F G 1 2 Stock price 3 Current date 4 Expiration date 5 Time to maturity, 6 Interest 7 27.82 12-Jul-07 16-Nov-07 0.35 <-- =(B4-B3)/365 5% Put Call option price Implied volatility Strike Implied volatility Strike option price 0.15 15.0 13.50 15.0 10 17.5 10.40 17.5 0.25 11 20.0 8.40 20.0 0.55 12 22.5 7.20 22.5 1.06 13 14 15 25.0 4.90 25.0 1.90 27.5 3.30 27.5 2.95 30.0 2.30 30.0 4.30 32.5 1.65 1.00 16 32.5 6.10 17 35.0 35.0 7.40 18 37.5 0.70 37.5 9.60 19 40.0 0.45 40.0 12.70 20 45.0 0.25 21 50.0 0.05

Step by Step Answer:

B Risk Neutral probability of up movement p 10...View the full answer

Related Video

A put option is a financial contract that gives the owner the right, but not the obligation, to sell an underlying asset, such as a stock or a commodity, at a predetermined price, known as the strike price, on or before a specific date, known as the expiration date. Put options are used by investors as a form of insurance against a decline in the value of the underlying asset. If an investor expects the value of an asset to fall in the future, they can purchase a put option on that asset. If the value of the asset does fall, the put option will increase in value, allowing the investor to sell the asset at the higher strike price. For example, if an investor owns 100 shares of a stock that is currently trading at $50 per share, they may purchase a put option with a strike price of $45 and an expiration date three months in the future. If the stock price falls to $40 before the expiration date, the investor can exercise the put option and sell their shares for $45 each, even though the market price is only $40. This would allow the investor to limit their losses. It\'s important to note that purchasing a put option involves paying a premium to the seller of the option, and the investor can lose the entire premium if the price of the underlying asset does not decline as expected. Put options are just one type of financial derivative and should only be used by experienced investors who understand the risks involved.

Students also viewed these Business questions

-

In an experiment, (a) Which variable is assumed to be the causal variable? (b) Which variable is assumed to be caused? (c) Which variable does the researcher manipulate? (d) Which variable occurs...

-

The market portfolio is assumed to be composed of four securities. Their covariances with the market and their proportions follow. Given these data, calculate the market portfolio's standard...

-

The 1200 KVA, 2,100 V synchronous motor is assumed to be a salient-pole machine with reactance Xdqrn= 1.9 ohm/phase and X= 1.6 ohm/phase. Neglecting all losses, find the maximum mechanical 3-phase...

-

The specifications for the water supply system of the Sears Tower in Chicago require that 100 gpm of water be pumped to a reservoir at the top of the tower, which is 340 m above street level. The...

-

For an individual planning to retire in ten years, with a thirty-year life expectancy in retirement, and with living expenses that will grow with inflation, what is the risk-free investment?

-

At the end of the first month of operations for FDNACCT, the business had earned P140,500 of revenues and incurred P71,500 of expenses. It also showed the following: Liabilities: P31,000 Assets:...

-

A chemical product was manufactured at two-week intervals, and after a period of storage the level of available chlorine, which is known to decline with time, was measured in cartons of the product...

-

Demand for stereo headphones and an MP3 player for joggers has caused Nina Industries to grow almost 50 percent over the past year. The number of joggers continues to expand, so Nina expects demand...

-

You owe $12,000 on student loans at an interest rate of 4.35% compounded monthly. You want to pay off the loan in 11 years. What will your monthly payments be

-

Abby Ellen opened Abbys Toy House. As her newly hired accountant, your tasks are to do the following: 1. Journalize the transactions for the month of March. Abby uses special journals for sales on...

-

Here?s an advanced version of exercise 10. Consider an alternative parameterization of the binomial: Construct binomial European call and put option pricing functions in VBA for this parameterization...

-

As shown in this chapter, Merton (1973) shows that for the case of an asset with price S paying a continuously compounded dividend yield k , this leads to the following call option pricing formula:C...

-

Repeat Problem 11.71, but assume that the compressor has an isentropic efficiency of 85% and the turbine an isentropic efficiency of 88%. Problem 11.71 A large stationary Brayton cycle gas-turbine...

-

1. create a concept map for 0D, 1D, 2D and 3D crystals 2. write down the formulas for quantifying numbers of defects

-

\fNOTES TO CONSOLIDATED FINANCIAL STATEMENTS OF AMERICAN AIRLINES GROUP INC . Commitments , Contingencies and Guarantees ( 2 ) Aircraft and Engine Purchase Commitment Under all of our aircraft and...

-

Critical Values. In Exercises 41-44, find the indicated critical value. Round results to two decimal places. 41. Z0.25 42. Z0.90 43. Z0.02 44. 20.05

-

Use the following information for questions 1 and 2. Caterpillar Financial Services Corp. (a subsidiary of Caterpillar) and Sterling Construction sign a lease agreement dated January 1, 2020, that...

-

In todays social and business environments, some organizations only talk the talk regarding ethics and ethical conduct rather than walk the ethical organizational path. In what ways can ethical and...

-

What is the relationship between neighboring layers in the TCP/IP model? What is the relationship between corresponding layers at the sender and receiver nodes?

-

Why should you not model a decision variable as a random variable with a probability distribution?

-

Define the characteristics of a charismatic leader.

-

Contrast transformational with transactional leaders.

-

Discuss trust and leadership. What makes a leader appear to be trustworthy?

-

All else constant, if the yield to maturity of a bond increases, the the value of the bond __________. a. increases b. decreases c. remains the same d. not enough information To answer enter a, b, c,...

-

Martha s Vineyard Marine Supply is a wholesaler for a large variety of boating and fishing equipment. The company s controller, Mathew Knight, has recently completed a cost study of the firm s...

-

1. Compute the productivity profiles for each year. If required, round your answers to two decimal places. 2a. Did productivity improve? 2b. Explain why or why not

Study smarter with the SolutionInn App