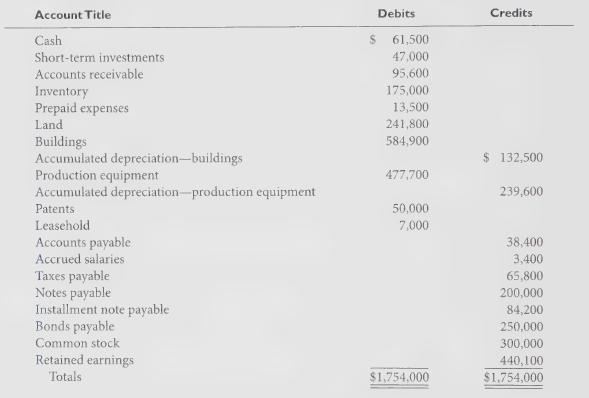

A December 31, 2008, post-closing trial balance for Short Erin Company follows. 1. Cash includes ($12,000) in

Question:

A December 31, 2008, post-closing trial balance for Short Erin Company follows.

1. Cash includes \($12,000\) in U.S. treasury bills purchased on December 21, 2008 that mature in January 2009. The account also includes \($8,500\) in stock purchased just before year-end that the company plans to sell in a few days.

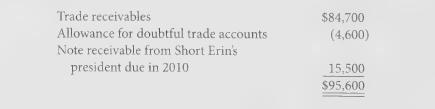

2. The Account receivable balance consists of:

Trade receivables includes \($1,400\) of customer accounts with credit balances.

3. Notes payable consists of two notes. One, in the amount of \($50,000\), is due on March 19, 2009. The other note matures on October 27, 2011\).

4. The Taxes payable account contains deferred income taxes amounting to \($61,250.

5.\) The installment note payable bears an annual interest rate of 10%. Semiannual payments of \($6,756.43\) are due each June 30 and December 31 and include principal and accrued interest.

These payments will reduce the Installment note balance by \($5,220\) in 2009.

6. Of the 1,000,000 authorized shares of no par common stock, 300,000 shares are issued and outstanding.

7. The company recently announced plans to sell its operating facility in Katy, Texas, consisting of land (cost \($82,000)\) and a building (cost \($175,000;\) book value \($110,000).\) Production equipment has already been removed from the Katy plant and is being used in other company facilities.

Required:

Prepare a classified balance sheet for the Short Erin Company at December 31, 2008.

Step by Step Answer: