Acute Company manufactures a single product. On December 31, 2005, it adopted the dollar-value LIFO inventory method.

Question:

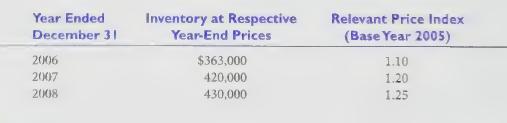

Acute Company manufactures a single product. On December 31, 2005, it adopted the dollar-value LIFO inventory method. The inventory on that date using the dollar-value LIFO inventory method was determined to be $300,000. Inventory data for succeeding years follow:

Required:

Compute the inventory amounts at December 31, 2006, 2007, and 2008, using the dollar-value LIFO inventory method for each year.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: