Amiel Company acquired 90% of the common stock of Talia Corporation on December 31, 20X0. The balance

Question:

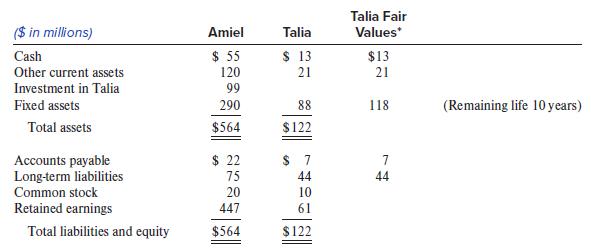

Amiel Company acquired 90% of the common stock of Talia Corporation on December 31, 20X0. The balance sheets of the two companies immediately after the acquisition was made are shown below:

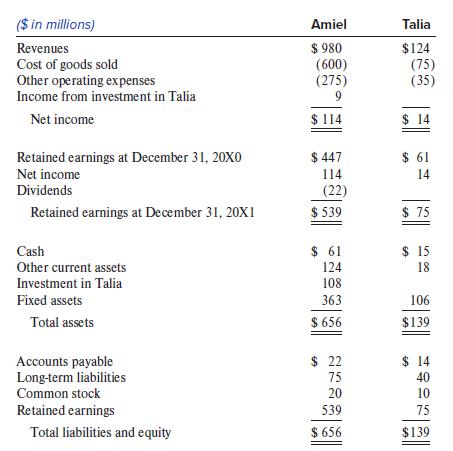

The following are the two companies’ income statements, retained earnings statements, and year-end balance sheets for 20X1. Amiel’s financial statements were prepared using the equity method to account for its investment in Talia.

Ignore income taxes.

Required:

1. Determine the amount of excess of acquisition value over book value of Talia, and the components of the excess.

2. Prepare Amiel’s consolidated balance sheet as of December 31, 20X0.

3. Determine the amount of excess value amortization for 20X1.

4. Prepare Amiel’s consolidated income statement, retained earnings statement, and year-end balance sheet for 20X1.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer