Coates Corporation is planning to enter into a three-year lease with annual payments of $30,000 due at

Question:

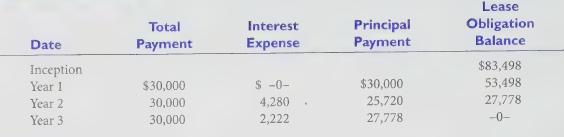

Coates Corporation is planning to enter into a three-year lease with annual payments of $30,000 due at the beginning of each year. If the lease qualified as a capital lease, the breakdown of the payments would be as follows:

Required:

1. If the lease were an operating lease, what would be the year-by-year effects on operating and financing cash flows?

2. If the lease were a capital lease, what would be the year-by-year effects on operating and financing cash flows?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: