Delhaize America operates retail food supermarkets in the southeastern and mid-Atlantic re-. gions of the United States.

Question:

Delhaize America operates retail food supermarkets in the southeastern and mid-Atlantic re-.

gions of the United States. The Company’s stores, Food Lion, Kash ‘n’ Karry, and Save ‘n’ Pack, sell a wide variety of groceries, including produce, meats, dairy products, seafood, frozen food, delicatessen and bakery foods, and nonfood items such as health and beauty care products, prescriptions, and other household and personal products.

In 1999 the company entered into a credit agreement with a group of banks. Excerpts taken from the loan agreement follow:

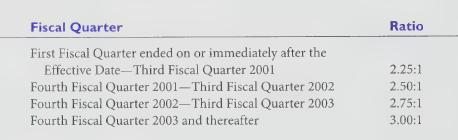

Section 6.07. Fixed Charges Coverage At the end of each Fiscal Quarter set forth below, the ratio of (i) Consolidated EBITDAR for the period of four Fiscal Quarters then ended to (ii) Consolidated Fixed Charges for such period, shall not have been less than the ratio set forth below opposite such Fiscal Quarter:

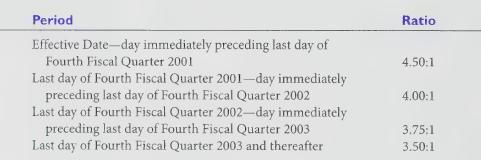

Section 6.08. Ratio of Consolidated Adjusted Debt to Consolidated EBITDAR At no date will the ratio of (i) Consolidated Adjusted Debt at such date to (ii) Consolidated EBITDAR for the period of four consecutive Fiscal Quarters ended on or most recently prior to such date exceed the ratio set forth below opposite the period in which such date falls:

EBITDAR is earning before interest, taxes, depreciation, amortization, and rent, and consolidated fixed charges means debt payments and interest expenses plus rent payments.

Required:

1. Why does the loan agreement include rent as a fixed charge in the EBITDAR coverage ratio described in Section 6.07?

2. The minimum acceptable EBITDAR coverage ratio (Section 6.07) increases from 2.25 at inception of the loan to 3.00 in the fourth quarter of 2003. How does the company benefit from this requirement? How does the lender benefit?

3. The debt-to-EBITDAR ratio described in Section 6.08 serves what purpose?

4. The maximum acceptable debt-to-EBITDAR ratio (Section 6.08) decreases from 4.50 at inception of the loan to 3.50 in the fourth quarter of 2003. How does the company benefit from this requirement? How does the lender benefit?

Step by Step Answer: