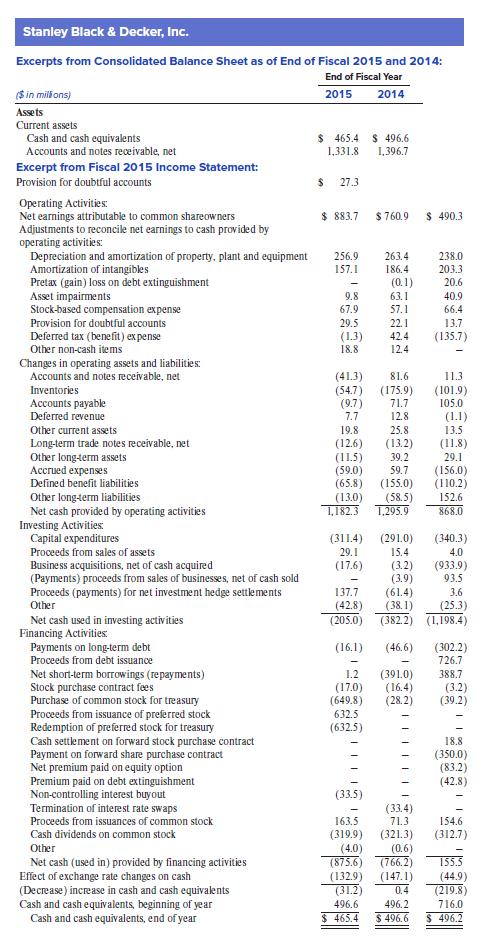

Excerpts from the financial statements of Stanley Black & Decker, Inc., follow. From Stanley Black & Deckers

Question:

Excerpts from the financial statements of Stanley Black & Decker, Inc., follow.

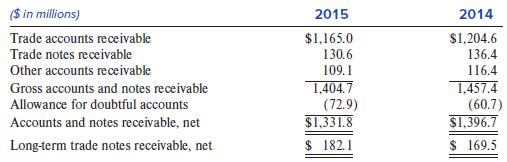

From Stanley Black & Decker’s Accounts receivable note:

Required:

1. Determine the difference between the change in accounts and notes receivable as reported in the statement of cash flows and the change in receivables based on the balance sheet. Do the same for long-term trade notes receivable. What are the likely reasons for the discrepancies?

2. Stanley Black & Decker reports a small change in cash relative to its operating cash flow for 2015. Explain why.

Stanley Black & Decker, Inc. Excerpts from Consolidated Balance Sheet as of End of Fiscal 2015 and 2014: End of Fiscal Year ($ in milik ons) 2015 2014 Assets Current assets Cash and cash equivalents Accounts and notes receivable, net $ 465.4 1,331.8 $ 496.6 1,396.7 Excerpt from Fiscal 2015 Income Statement: Provision for doubtful accounts 27.3 Operating Activities: Net earnings attributable to common shareowners Adjustments to reconcile net earnings to cash provided by operating activities: Depreciation and amortization of property, plant and equipment Amortization of intangibles Pretax (gain) loss on debt extinguishment $ 883.7 $ 760.9 $ 490.3 256.9 263.4 238.0 157.1 186.4 203.3 (0.1) 20.6 Asset impairments Stock-based compensation expense 9.8 63.1 40.9 67.9 57.1 66.4 Provision for doubtful accounts 29.5 22.1 13.7 Deferred tax (benefit) ex pense (1.3) 18.8 (135.7) 42.4 Other non-cash items 12.4 Changes in operating assets and liabilities: Accounts and notes receivable, net (41.3) (54.7) (175.9) (9.7) 7.7 81.6 11.3 Inventories (101.9) Accounts payable Deferred revenue 71.7 105.0 12.8 (1.1) Other current assets 19.8 25.8 13.5 Long-term trade notes receivable, net Other long-term assets Accrued expenses Defined benefit liabilities (12.6) (11.5) (59.0) (65.8) (13.0) 1,182.3 (13.2) 39.2 (11.8) 29.1 (156.0) (110.2) 59.7 (155.0) (58.5) 1,295.9 Other long-term liabilities Net cash provided by operating activities Investing Activities: Capital expenditures 152.6 868.0 (311.4) (291.0) (340.3) Proceeds from sales of assets 29.1 15.4 4.0 Busine ss acquisitions, net of cash acquired (Payments) proceeds from sales of businesses, net of cash sold (17.6) (3.2) (3.9) (61.4) (38. 1) (382.2) (933.9) 93.5 Proceeds (payments) for net investment hedge settlements Other 137.7 3.6 (42.8) (205.0) (25.3) (1,198.4) Net cash used in investing activities Financing Activities Payments on long-term debt Proceeds from debt issuance (16.1) (46.6) (302.2) 726.7 Net short-term borrowings (repayments) Stock purchase contract fees Purchase of common stock for treasury Proceeds from issuance of preferred stock Redemption of preferred stock for treasury (391.0) (16.4) (28.2) 1.2 388.7 (17.0) (649.8) (3.2) (39.2) 632.5 (632.5) Cash settlement on forward stock purchase contract Payment on forward share purchase contract Net premium paid on equity option Premium paid on debt extinguishment Non-controlling interest buyout Termination of interest rate swaps 18.8 (350.0) (83.2) (42.8) (33.5) (33.4) 71.3 Proceeds from issuances of common stock 163.5 154.6 Cash dividends on common stock (319.9) (4.0) (875.6 (132.9) (31.2) (321.3) (0.6) (766.2) (147.1) (312.7) Other 155.5 Net cash (used in) provided by financing activities Effect of exchange rate changes on cash (Decrease) increase in cash and cash equivaents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year (44.9) (219.8) 0.4 496.6 496.2 716.0 $ 465.4 $ 496.6 496.2

Step by Step Answer:

Requirement 1 The 2015 cash flow statement showed an increase in accounts and notes receivable of 41...View the full answer

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

Related Video

This video explains the basic understanding of a group. The term control is acquired when a parent company acquires more than 50% voting rights of subsidiaries. We have covered the basic structure of the consolidated balance sheet, with multiple scenarios of 100% and partial acquisitions at the start and during an accounting period. Also, goodwill and Non-controlling interest are covered in detail

Students also viewed these Business questions

-

Excerpts from the financial statements of Stanley Black & Decker, Inc. follow. Stanley Black & Decker, Inc. Excerpts from Consolidated Balance Sheet as of End of Fiscal 2015 and 2014: End of Fiscal...

-

The statement of cash flows has become a commonly provided financial statement by companies throughout the world. It is interesting to note, however, that its format does vary across countries. The...

-

The following information is taken from the financial statements of Ramsay Health Care Inc.: Required: 1. Reconstruct all journal entries relating to Gross accounts receivable and Allowance for...

-

Ava bought a house on 1 July 2000 for 62,000. She occupied the entire property as her PPR until 1 August 2007 when she began using one-quarter of the house for business purposes. This continued until...

-

The Professional Golf WH Association (PGA) and Golf Digest have developed the Play Golf America program, in which teaching professionals at participating golf clubs provide a free 10-minute lesson to...

-

I:9-1 What is the closed transaction doctrine, and why does it exist for purposes of recognizing a loss realized on holding property?

-

4. This problem has been intentionally omitted for this edition.

-

Why are convertible bonds less risky than stock but usually more risky than nonconvertible bonds?

-

A HIGH receivable turnover ratio indicates A) customers are making payments very quickly. B)customers are making payments slowly. C)the company's sales are increasing. D) the company should go out of...

-

Study the DreamHome case study presented in Section 11.4 and Appendix A. (a) In what ways would a DBMS help this organization? (b) What do you think are the main objects that need to be represented...

-

Superfine Company collected the following data in preparing its cash flow statement for the year ended December 31, 20X1: Amortization of bond discount $ 1,000 Dividends declared 22,500 Dividends...

-

Alp Inc. had the following activities during 20X1: Acquired 2,000 shares of stock in Maybel Inc. for $26,000. Sold an investment in Rate Motors for $35,000 when the carrying value was $33,000. ...

-

On January 1, 2016, Nantucket Ferry borrowed $14,000,000 cash from BankOne and issued a four-year, $14,000,000, 6% note. Interest was payable annually on December 31. Prepare the journal entries for...

-

Use the Comparison Theorem to determine whether the integral is convergent or divergent. L da

-

Problem 3 (2 scenarios) Scenario 1: Rocky Inc hired a new intern from CSU to help with year-end inventory. The intern computed the inventory counts at the end of 2020 and 2021. However, the intern's...

-

A CM reactor receives influent containing 10.0 mg/L of tracer for 2 h. Then tracer addition is terminated but the flow remains steady. The volume of the reactor is 10 L and the flow rate is 2 L / h....

-

Solve the given system of equations graphically by using a graphing calculator. y=5x x+y2=81 Find the solution with the smaller x-value. x= y= (Type an integer or a decimal rounded to one decimal...

-

I-The market for Sony's Playstation5 game console has changed from 2021 to 2023. With restrictions from the Covid-19 pandemic ending people are finding other entertainment options available such as...

-

In problem use Theorem 7.4.3 to find the Laplace transform of the given periodic function. THEOREM 7.4.3 If f (t) is piecewise continuous on [0, ), of exponential order, and periodic with period T,...

-

What kind of rays are X-rays?

-

Joel Hamilton, D.D.S., keeps his accounting records on the cash basis. During 2014, he collected $200,000 in fees from his patients. At December 31, 2013, Dr. Hamilton had accounts receivable of...

-

Under Hart Companys accounting system, all insurance premiums paid are debited to prepaid insurance. For interim financial reports, Hart makes monthly estimated charges to Insurance expense with...

-

Munnster Corporations income statements for the years ended December 31, 2014, and 2013 included the following information before adjustments: On January 1, 2014, Munnster Corporation agreed to sell...

-

If you purchase a $1000 par value bond for $1065 that has a 6 3/8% coupon rate and 15 years until maturity, what will be your annual return? 5.5% 5.9% 5.7% 6.1%

-

Famas Llamas has a weighted average cost of capital of 8.8 percent. The companys cost of equity is 12 percent, and its pretax cost of debt is 6.8 percent. The tax rate is 22 percent. What is the...

-

The common stock of a company paid 1.32 in dividens last year. Dividens are expected to gros at an 8 percent annual rate for an indefinite number of years. A) If the company's current market price is...

Study smarter with the SolutionInn App