Hershey Foods Corporation manufactures and sells consumer food products including chocolate bars, chocolate drink mixes, refrigerated puddings,

Question:

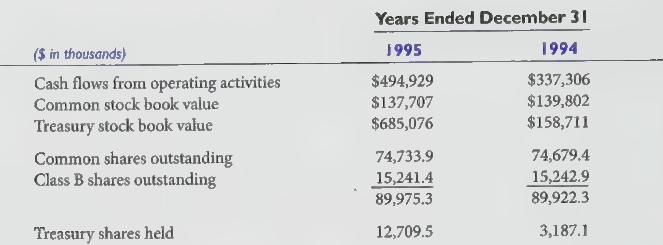

Hershey Foods Corporation manufactures and sells consumer food products including chocolate bars, chocolate drink mixes, refrigerated puddings, beverages, pasta, cough drops, and jelly beans. In August 1995, the company repurchased 9,049,773 shares of common stock from a single stockholder-Milton Hershey School Trust-for \($500\) million. This stock buyback plus other repurchases that year reduced shareholders' equity by 25%. Excerpts from Hershey Foods' 1995 annual report follow:

As of December 31, 1995, the Corporation had 530,000,000 authorized shares of capital stock. Of this total, 450,000,000 shares were designated as Common Stock, 75,000,000 shares as Class B Common Stock (Class B Stock), and 5,000,000 shares as Preferred Stock, each class having a par value of one dollar per share. As of December 31, 1995, a combined total of 89,975,436 shares of both classes of common stock had been issued, of which 77,265,883 shares were outstanding. No shares of the Preferred Stock were issued or outstanding during the three-year period ended December 31, 1995.

Holders of the Common Stock and the Class B Stock generally vote together without regard to class on matters submitted to stockholders, including the election of directors, with the Common Stock having one vote per share and the Class B stock having ten votes per share. However, the Common Stock, voting separately as a class, is entitled to elect one-sixth of the Board of Directors. With respect to dividend rights, the Common Stock is entitled to cash dividends 10% higher than those declared and paid on the Class B Stock . . . Class B Stock can be converted into Common Stock on a share-for-share basis at any time.

Hershey Trust Company, as Trustee for the benefit of Milton Hershey School... and as direct owner of investment shares . . . was entitled to cast approximately 76% of the total votes of both classes of the Corporation’s common stock [as of December 31, 1995]. The Milton Hershey School Trust must approve the issuance of shares of Common Stock or any other action which would result in the Milton Hershey School Trust not continuing to have voting control of the Corporation.

In August 1995, the Corporation purchased an additional 9,049,773 shares of its Common Stock to be held as Treasury Stock from the Milton Hershey School Trust for \($500.0\) million. In connection with the share repurchase program begun in 1993, a total of 2,000,000 shares were also acquired from the Milton Hershey School Trust in 1993 for approximately \($103.1\) million.

Required:

1. Why did Hershey issue two classes of common stock? Both types have a \($1\) par value. Do they have the same market price?

2. On the basis of the 1995 year-end balance sheet amounts, compute the average price per share that Hershey received for its common and Class B shares.

3. Compute the average price Hershey paid for treasury stock held at the end of 1994. How does this price compare to the average price paid for treasury shares held at the end of 1995?

4, What per share price did Hershey pay for the shares it bought back from Milton Hershey School Trust in 1995 and in 1993?

5. Why did the company buy back its shares? What are some other reasons companies repurchase their common stock?

6. Asa credit analyst, how would you react to the company’s announcement of its 1995 stock buyback?

Step by Step Answer: