In January 2008, Action Corporation entered into a contract to acquire a new machine for its factory.

Question:

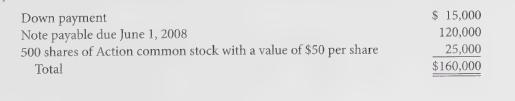

In January 2008, Action Corporation entered into a contract to acquire a new machine for its factory. The machine, which had a cash price of \($150,000\), was paid for as follows:

Prior to the machine’s use, installation costs of \($4,000\) were incurred. The machine has an estimated useful life of 10 years and an estimated salvage value of $5,000.

Required:

What should Action record as depreciation expense for 2008 under the straight-line method?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: