London, Inc. began operation ofi ts construction division on October 1, 2008 and entered into contracts for

Question:

London, Inc. began operation ofi ts construction division on October 1, 2008 and entered into contracts for two separate projects. The Beta project contract price was \($600,000\) and provided for penalties of \($10,000\) per week for late completion. Although during 2009 the Beta project had been on schedule for timely completion, it was completed four weeks late in August 2010.

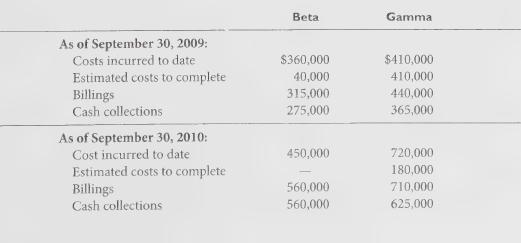

The Gamma project’s original contract price was \($800,000\). Change orders during 2010 added

\($40,000\) to the original contract price. The following data pertain to the separate long-term construction projects in progress:

Additional Information London accounts for its long-term construction contracts using the percentage-of-completion method for financial reporting purposes and the completed-contract method for income tax purposes.

Required:

1. Prepare a schedule showing London’s gross profit (loss) recognized for the years ended September 30, 2009 and 2010 under the percentage-of-completion method.

2. Prepare a schedule showing London's balances in the following accounts at September 30, 2009 under the percentage-of-completion method:

• Accounts receivable • Costs and estimated earnings in excess of billings • Billings in excess of costs and estimated earnings 3. Determine how much income would be recognized if London used the completed-contract method for the 2009 and 2010 fiscal years.

Step by Step Answer: