Microsoft Corporation develops, manufactures, licenses, and supports a wide range of software products for many computing devices.

Question:

Microsoft Corporation develops, manufactures, licenses, and supports a wide range of software products for many computing devices. The company’s software products include operating systems for servers, personal computers, and intelligent devices; server applications for distributed computing environments; information worker productivity applications; business solution applications; high-performance computing applications; and software development tools. Microsoft provides consulting and product support services and trains and certifies computer system integrators and developers. The company also sells the Xbox 360 video game console and games, PC games, and peripherals. Online offerings and information are delivered through Windows Live, Office Live, and MSN portals and channels. Microsoft also researches and develops advanced technologies for future software products.

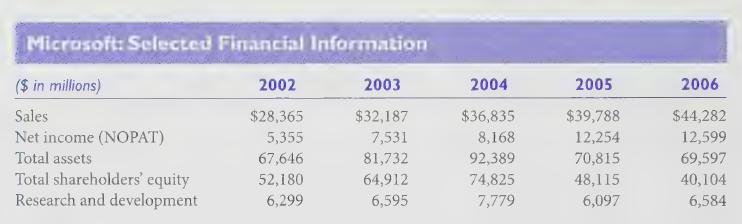

Income statement and balance sheet information from Microsoft’s recent annual reports to shareholders follows. Assume an income tax rate of 35%.

Required:

1. How does current GAAP require firms to account for their research and development expenditures?

2. Use the reported information to calculate Microsoft’s net operating profit after taxes divided by sales margin (NOPAT), asset turnover (sales divided by average total assets), return on assets (NOPAT divided by average total assets), and return on shareholders’ equity (NOPAT divided by average shareholders’ equity) for 2004, 2005, and 2006.

3. Assume that Microsoft expects its research and development expenditures to benefit the current accounting period as well as the next two accounting periods. Briefly describe how Microsoft's 2004 income statement and balance sheet would be different if it had capitalized rather than expensed its research and development (R&D) expenditures.

4. Repeat requirement 2 after capitalizing R&D expenditures and amortizing them as described in requirement 3. As a statement reader, would you find the differences in the ratios in requirements 2 and 4 to be significant? Why?

Step by Step Answer: