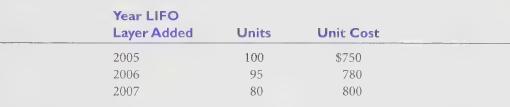

Miller's Snow Blowers, Inc. had the following layers in its LIFO inventory at January 1, 2008: The

Question:

Miller's Snow Blowers, Inc. had the following layers in its LIFO inventory at January 1, 2008:

The company sets its selling price at 180% of replacement cost at the time of the sale. Replacement cost as of January 1, 2008 was $825 per unit and remained unchanged throughout 2008.

During 2008, the company purchased 475 units and sold 675 units.

Required:

Calculate the difference between Miller’s current cost operating margin (that is, on a replacement cost basis) and the LIFO operating margin as reported by the company in 2008. What does this difference represent?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: