Moss, Inc. uses the accrual method of accounting for financial reporting purposes and appropriately uses the installment

Question:

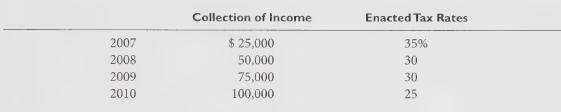

Moss, Inc. uses the accrual method of accounting for financial reporting purposes and appropriately uses the installment method of accounting for income tax purposes. It will collect $250,000 of installment income in the following years when the enacted tax rates are as indicated.

The installment income is the firm’s only temporary difference.

Required:

What amount should be included as the deferred income tax liability in Moss's December 31, 2007 balance sheet?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: