Motorola and Intel are both in the semiconductor industry and compete in many of the same product

Question:

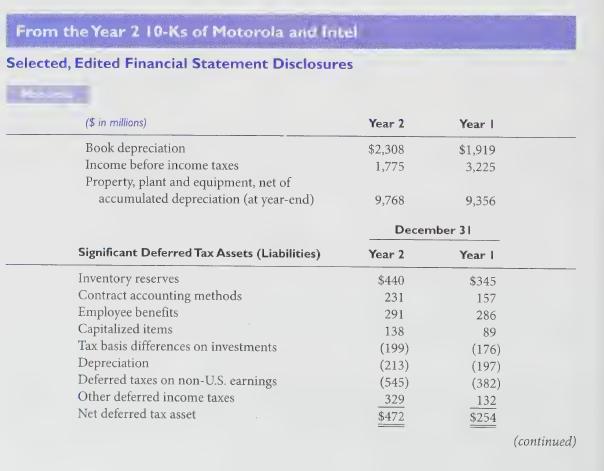

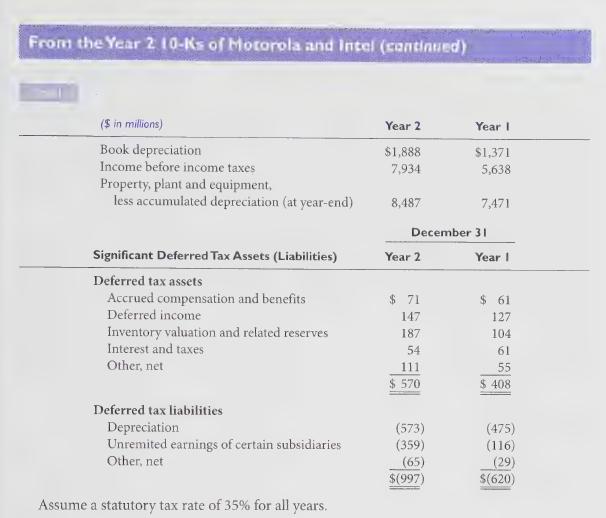

Motorola and Intel are both in the semiconductor industry and compete in many of the same product sectors. But each uses a different depreciation method. Motorola's Year 2 10-K states the following:

Depreciation is recorded principally using the declining-balance method based on the estimated useful lives of the assets (buildings and building equipment, 5-50 years; machinery and equipment, 2-12 years).

So, Motorola is using accelerated depreciation for most of its assets. By contrast, Intel's Year 2 report says:

Depreciation is computed for financial reporting purposes principally by use of the straight-line method over the following estimated useful lives: machinery and equipment, 2 to 4 years; land and buildings, 4 to 45 years.

The following table gives several key financial statement figures for each company from its respective Year 2 10-K and excerpts from its income tax footnote:

Required:

1. Using the information provided and the analytical techniques illustrated in the chapter, determine the tax depreciation for Motorola and Intel for Year 2.

2. Adjust each firm’s pre-tax income to reflect the same depreciation method and useful lives used for tax purposes.

3. Explain why the adjusted numbers provide a better basis for comparing the operating performance of the two companies.

Step by Step Answer: