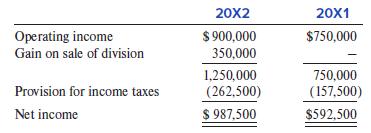

Munnster Corporations income statements for the years ended December 31, 20X2 and 20X1, included the following information

Question:

Munnster Corporation’s income statements for the years ended December 31, 20X2 and 20X1, included the following information before adjustments:

On January 1, 20X2, Munnster Corporation agreed to sell the assets and product line of one of its operating divisions for $2,000,000. The sale was consummated on December 31, 20X2, and it resulted in a pre-tax gain on disposition of $350,000. This division’s pre-tax net losses were $505,000 in 20X2 and $170,000 in 20X1. The income tax rate for both years was 21%.

Required:

Starting with operating income (before tax), prepare revised comparative income statements for 20X2 and 20X1 showing appropriate details for gain (loss) from discontinued operations.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer