Neville Company decides at the beginning of 2008 to adopt the FIFO method of inventory valuation. It

Question:

Neville Company decides at the beginning of 2008 to adopt the FIFO method of inventory valuation.

It had used the LIFO method for financial and tax reporting since its inception on January 1, 2006, and had maintained records that are sufficient to retrospectively apply the FIFO method. Neville concluded that the FIFO method is the preferable inventory valuation method for its inventory (it was the lone member of its industry that used LIFO; its competitors all valued inventory using FIFO).

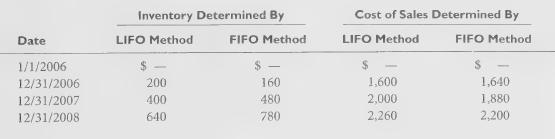

The effects of the change in accounting principle on inventory and cost of sales are presented in the following table:

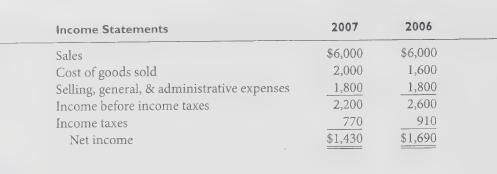

For each year presented, assume that sales are \($6,000\) and selling, general, and administrative expenses are \($1,800\). Neville Company's effective income tax rate for all years is 35% (there are no permanent or temporary differences under SFAS No. 109, “Accounting for Income Taxes,’

prior to the change). Neville’s annual report provides two years of financial results. The company’s income statements as originally reported under the LIFO method follow.

Required:

1. Prepare Neville Company's 2008 and 2007 income statements reflecting the retrospective application of the accounting change from the LIFO method to the FIFO method.

2. Prepare Neville Company’s disclosure related to the accounting change; limit disclosure of financial statement line items affected by the change in accounting principle to those appearing on the company’s income statements for the years presented.

Step by Step Answer: