On December 31, 2008, Thomas Henley, financial vice president of Kingston Corporation, signed a noncancelable three-year lease

Question:

On December 31, 2008, Thomas Henley, financial vice president of Kingston Corporation,

signed a noncancelable three-year lease for an item of manufacturing equipment. The lease

called for annual payments of \($41,635\) per year due at the end of each of the next three years.

The leased equipment’s expected economic life was four years. No cash changed hands because

the first payment wasn't due until December 31, 2009.

Henley was talking with his auditor that afternoon and was surprised to learn that the lease

qualified as a capital lease and would have to be put on the balance sheet. Although his intuition

told him that capitalization adversely affected certain ratios, the size of these adverse

effects was unclear to him. Because similar leases on other equipment were up for renewal in

2009, he wanted a precise measure of the ratio deterioration. “If these effects are excessive.” he

said, “I'll try to get similar leases on the other machinery to qualify as operating leases when

they come up for renewal next year.”

Assume that the appropriate rate for discounting the minimum lease payments is 12%.

(The present value of an ordinary annuity of \($1\) per period for three periods at 12% is 2.40183.)

Also assume that the asset Leased equipment under capital leases will be depreciated on a

straight-line basis.

Required:

1. Prepare an amortization schedule for the lease.

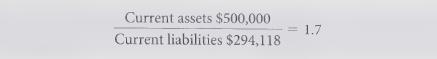

2. The effect of lease capitalization on the current ratio worried Henley. Before factoring in

the capital lease signed on December 31, 2008, Kingston Corporation’s current ratio at

December 31, 2008 was:

Once this lease is capitalized on December 31, 2008, what is the adjusted December 31,

2008 current ratio?

3. Henley was also concerned about the effect that lease capitalization would have on net

income. He estimated that if the lease previously described were treated as an operating

lease, 2009 pre-tax income would be \($225,000\). Determine the 2009 pre-tax income ona

capital lease basis if this lease were treated as a capital lease and if the leased equipment

were depreciated on a straight-line basis over the life of the lease.

Step by Step Answer: