On January 1, 2008, Cello Co. established a defined benefit pension plan for its employees. At January

Question:

On January 1, 2008, Cello Co. established a defined benefit pension plan for its employees. At January 1, 2008, Cello estimated the service cost for 2008 to be \($45,000\). At January 1, 2009, it estimated 2009 service cost to be \($49,000\). On the plan inception date, prior service credit was granted to employees for five years, the period of time between the company's formation and plan inception. The prior service cost was estimated to be \($650,000\) at January 1, 2008. Cello uses a 10% discount rate and assumes a return on plan assets of 9%. The average remaining service life of employees is 20 years, and the company will fund at the end of each year an amount equal to service cost plus interest cost for 2008 and 2009.

Required:

1. Compute the amount of prior service cost to be included as a component of pension expense for 2008.

2. Compute pension expense for 2008.

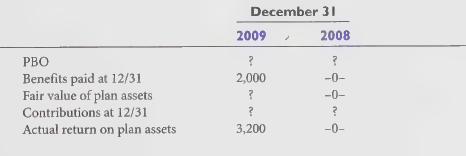

3. Compute the fair value of plan assets at December 31, 2008.

4. Compute the PBO balance at December 31, 2008.

S . Prepare the company’s required journal entries to record the effects of its pension plan in 2008.

6. Repeat requirements | through 5 for 2009.

7. Prepare T-accounts for Pension asset (liability), AOCI—prior service cost, and AOCI—net actuarial (gain) loss to show the effects of the entries made in requirements 5 and 6. Label the effects.

Step by Step Answer: