On January 1, 2008, Mason Manufacturing borrows $500,000 and uses the money to purchase corporate bonds for

Question:

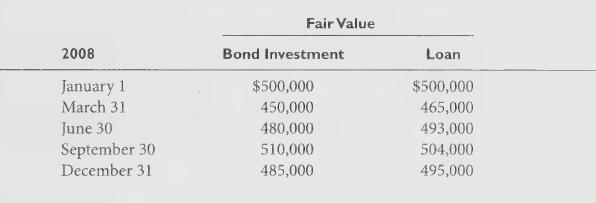

On January 1, 2008, Mason Manufacturing borrows $500,000 and uses the money to purchase corporate bonds for investment purposes. Interest rates were quite volatile that year and so were the fair values of Mason’s bond investment (an asset) and loan (a liability):

Required:

1. Mason is required to use fair value accounting for the bond investment. Prepare the journal entry to record the investment purchase on January 1, 2008 and the fair value adjustments required at the end of each quarter: March 31, June 30, September 30, and December 31.

2. Suppose that Mason uses conventional amortized historical cost accounting for the loan.

The loan principal is due in five years. Ignore interest on the loan to simplify the problem.

What will be the loan’s carrying value at the end of each quarter?

3. Suppose that instead Mason elects to use the fair value option permitted by SFAS No. 159 for the loan. What dollar impact will this change have on reported profits each quarter?

4. Which accounting approach—unamortized historical cost or fair value—do you believe Mascon should use for the loan? Why?

Step by Step Answer: