Over the past two years, Madison Corporation has accumulated operating loss carryforwards of ($66,000). This year, 2008,

Question:

Over the past two years, Madison Corporation has accumulated operating loss carryforwards of \($66,000\). This year, 2008, Madison's pre-tax book income is \($101,500\). The company is subject to a 40% corporate tax rate. The following items are relevant to Madisons deferred tax 3 computations for 2008.

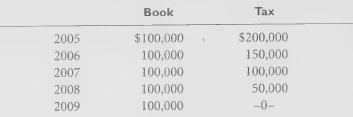

1. Equipment purchased in 2005 is depreciated on a straight-line basis for financial reporting purposes and using an accelerated method for tax purposes as follows:

2. Madison's trading securities portfolio generated a \($13,000\) unrealized gain that is not recognized for tax purposes until the securities are sold.

3. Madison has not yet paid its rent for November and December of 2008, a total of \($25,000\).

The expense was accrued for book purposes and is included in pre-tax book income.

4. During 2008, Madison paid a \($6,500\) fine to its state corporation commission for allegedly violating state security laws. Madison neither denied nor admitted guilt related to the charges. The expense is not deductible for tax purposes but has been included in computing pre-tax book income.

Required:

1. Determine Madison Corporation’s taxable income for 2008.

2. Calculate the amount of tax payable for Madison Corporation for 2008.

Step by Step Answer: