Refer to the facts in problem P18-7. Required: 1. Translate Mavrogeness 20X1 Income Statement into U.S. dollars

Question:

Refer to the facts in problem P18-7.

Required:

1. Translate Mavrogenes’s 20X1 Income Statement into U.S. dollars using the temporal method.

2. Translate Mavrogenes’s 20X1 Statement of Retained Earnings into U.S. dollars using the temporal method.

3. Translate Mavrogenes’s December 31, 20X1, Balance Sheet into U.S. dollars using the temporal method.

4. “Prove” the foreign exchange gain or loss you found for 20X1.

5. Translate Mavrogenes’s 20X2 Income Statement into U.S. dollars using the temporal method.

6. Translate Mavrogenes’s 20X2 Statement of Retained Earnings into U.S. dollars using the temporal method.

7. Translate Mavrogenes’s December 31, 20X2, Balance Sheet into U.S. dollars using the temporal method.

8. “Prove” the foreign exchange gain or loss you found for 20X2.

P18-7.

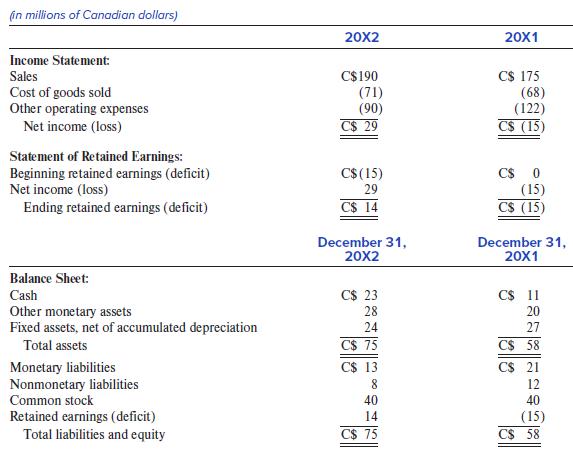

Mavrogenes Corporation is a wholly owned Canadian subsidiary of a U.S. parent company. Mavrogenes was formed on January 1, 20X1, when the parent invested C$40 million and Mavrogenes issued 100 shares of common stock. The following are Mavrogenes’s Canadian dollar financial statements for 20X1 and 20X2:

All transactions were entered into evenly throughout the year, except for the funding by Mavrogenes’s parent on January 1, 20X1, and the purchase of C$30 million in fixed assets, which also took place on January 1, 20X1. The fixed assets are being depreciated using the straight-line method over 10 years with no salvage value. Depreciation expense is included in Other operating expenses.

The following are relevant exchange rates, all expressed as the U.S. dollar value of 1 Canadian dollar:

January 1, 20X1 | 0.80 |

Average for 20X1 | 0.83 |

December 31, 20X1 | 0.87 |

Average for 20X2 | 0.86 |

December 31, 20X2 | 0.84 |

Ignore income taxes.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer