Selected pension information extracted from AMRs 2006 annual report follows. Author modifications have been made to reflect

Question:

Selected pension information extracted from AMR’s 2006 annual report follows. Author modifications have been made to reflect amounts as if SFAS No. 158 had been adopted as of December 31, 2005.

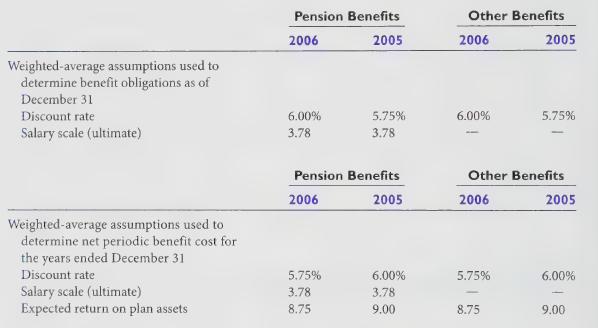

10. Retirement Benefits All employees of the Company may participate in pension plans if they meet the plans’ eligibility requirements. The defined benefit plans provide benefits for participating employees based on years of service and average compensation for a specified period of time before retirement. The Company uses a December 31 measurement date for all of its defined benefit plans. American's pilots also participate in a defined contribution plan for which Company contributions are determined as a percentage (11 percent) of participant compensation.

Certain non-contract employees (including all new non-contract employees)

participate in a defined contribution plan in which the Company will match the employees’

before-tax contribution on a dollar-for-dollar basis, up to 5.5 percent oft heir pensionable pay.

In addition to pension benefits, other postretirement benefits, including certain health care and life insurance benefits (which provide secondary coverage to Medicare), are provided to retired employees. The amount of health care benefits is limited to lifetime maximums as outlined in the plan. Substantially all regular employees of American and employees of certain other subsidiaries may become eligible for these benefits if they satisfy eligibility requirements during their working lives.

Certain employee groups make contributions toward funding a portion of their retiree health care benefits during their working lives. The Company funds benefits as incurred and makes contributions to match employee prefunding.

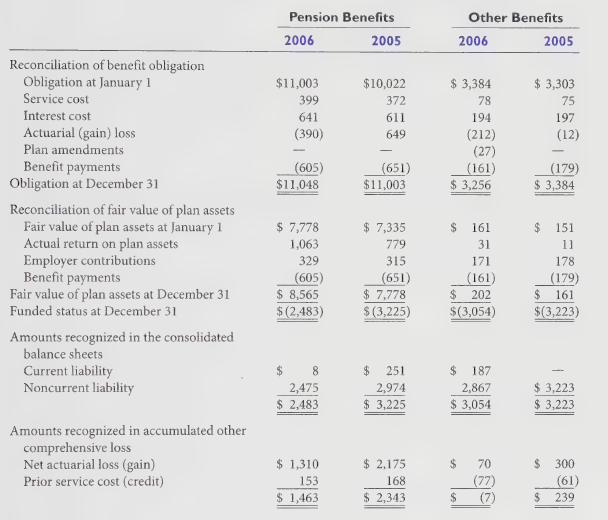

The following table provides a reconciliation of the changes in the pension and other benefit obligations and fair value of assets for the years ended December 31, 2006 and 2005, and a statement of funded status as of December 31, 2006 and 2005 (in millions):

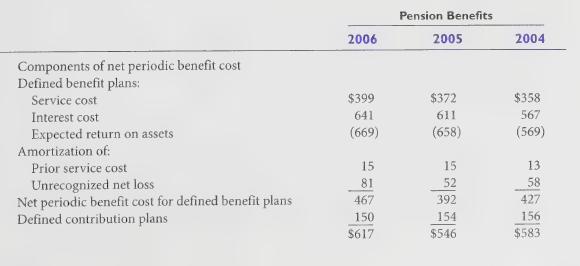

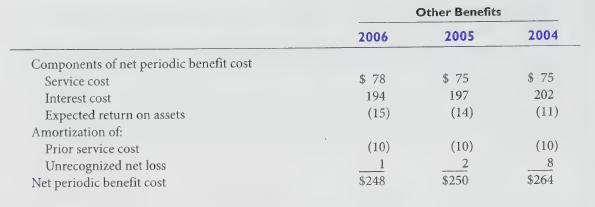

The following tables provide the components of net periodic benefit cost for the years ended December 31, 2006, 2005 and 2004 (in millions):

The estimated net loss and prior service cost for the defined benefit pension plans that will be amortized from accumulated other comprehensive income into net periodic benefit cost over the next fiscal year are \($25\) million and \($16\) million, respectively. The estimated net gain and prior service credit for the other postretirement plans that will be amortized from accumulated other comprehensive income into net periodic benefit cost over the next fiscal year are \($7\) million and \($13\) million, respectively.

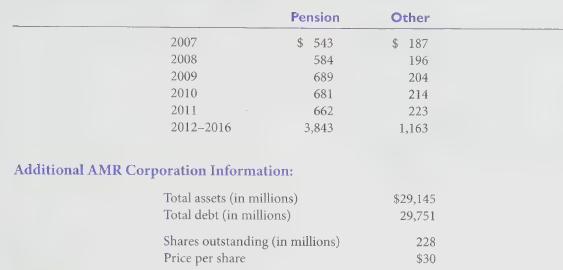

The Company expects to contribute approximately \($364\) million to its defined benefit pension plans and \($13\) million to its postretirement benefit plan in 2007. In addition to making contributions to its postretirement benefit plan, the Company funds the majority of the benefit payments under this plan.

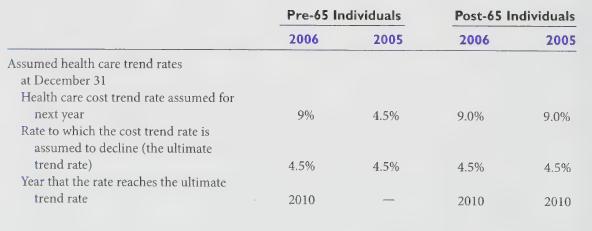

This estimate reflects the provisions of the Pension Funding Equity Act of 2004 and the Pension Protection Act of 2006. The following benefit payments, which reflect expected future service as appropriate, are expected to be paid:

Required:

1. Pension plans

a. Reconstruct the journal entries that AMR would have made for its pension plan in 2006.

b. Compute the Bear Stearns short-term and long-term pension risk ratios as of December 31, 2006.

c. Based on your answer to requirement 1(b), does AMR have low or high pension risk?

2. Other benefit plans

a. Explain what probably caused the \($(212)\) in the actuarial (gain) loss in the benefit obligation.

b. The reconciliation of the benefit obligation indicates that the Plan amendments decreased the obligation by \($27.\) Explain why a plan amendment would decrease the obligation.

c. Compute the pre-tax effect of other benefits on AMR's OCI.

d. Compute the Bear Stearns short-term and long-term OPEB risk ratios as of December 31, 2006.

e. Based on your answer to requirement 2(d), does AMR have low or high OPEB risk?

Step by Step Answer: