Silverado Inc. buys titanium from a supplier that requires a six-month firm commitment on all purchases. On

Question:

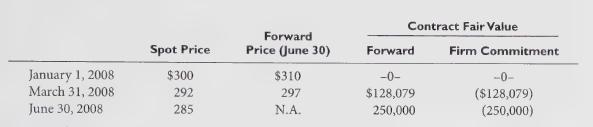

Silverado Inc. buys titanium from a supplier that requires a six-month firm commitment on all purchases. On January 1, 2008, Silverado signs a contract with the supplier to purchase 10,000 pounds of titanium at the current forward rate of \($310\) per pound with settlement on June 30, 2008. However, Silverado wants to actually pay the June 30 market price for titanium. To achieve this goal, the company enters into a forward contract to sell 10,000 pounds of titanium at the current forward price of \($310\) per unit. The firm commitment contract and the forward con- tract both have zero value at inception. Titanium spot prices and the contract fair values are:

Required:

1. Why did Silverado hedge its firm commitment with the supplier? After the fact, was it a good idea to do so?

2. What journal entries were made when the two contracts are signed on January 1, 2008?

3. Silverado designated the forward contract as a fair value hedge of its future titanium purchase. What journal entries were made on March 31, 2008?

4, What journal entries were made on June 30, 2008 when the contracts are settled and Silverado pays for the titanium?

Step by Step Answer: