Sunny Day Stores operates convenience stores throughout much of the United States. The industry is highly competitive,

Question:

Sunny Day Stores operates convenience stores throughout much of the United States. The industry is highly competitive, with low profit margins. The company's competition includes national, regional, and local supermarkets; oil companies; and convenience store operators.

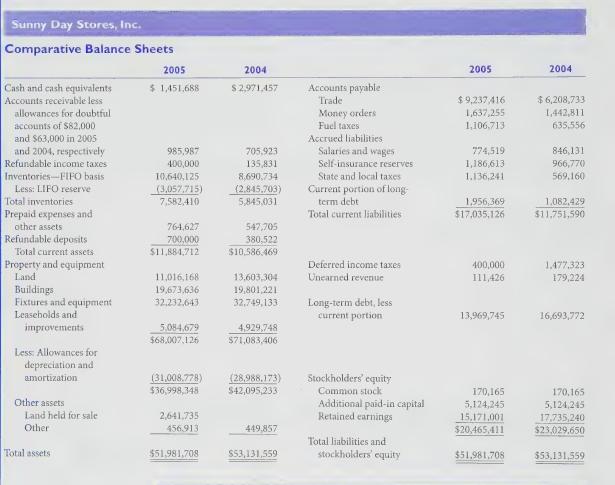

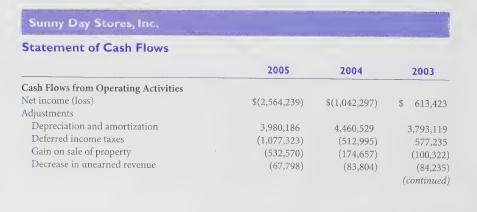

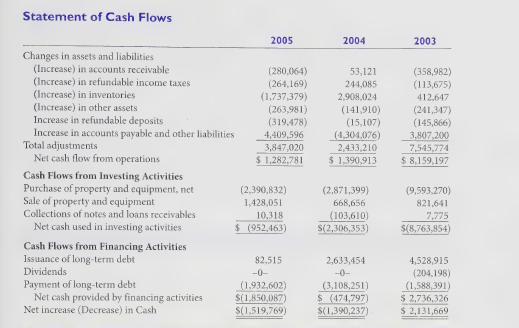

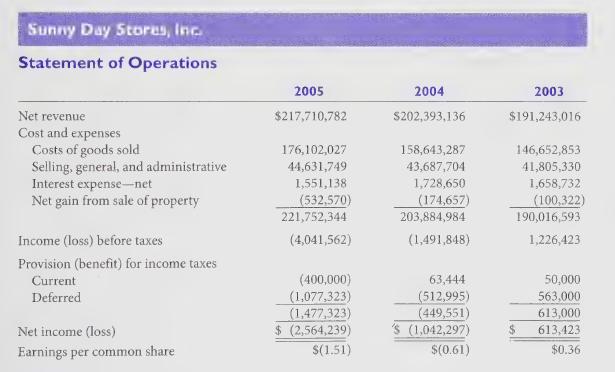

A footnote to the 2005 financial statements described the company’s long-term debt:

Note payable to the Prudential Insurance Company of America (“Prudential”) with annual principal payments of \($900,000\), interest at 8.93%. Amount outstanding: \($5,700,000\) in 2005 and \($6,600,000\) in 2004.

Term note payable to First Florida Bank (“First Florida”) maturing in September 2010, with quarterly principal payments of \($125,000\) through June 30, 2006 and \($250,000\) thereafter, with interest at 1% in excess of prime (5.5% at December 26, 2005). Amount outstanding \($3,563,956\) in 2005 and \($3,000,000\) in 2004.

Revolving note payable to First Florida Bank with interest at 1% in excess of prime (5.5% at December 26, 2005). Amount outstanding: \($7,400,000\) in 2005 and 2094.

Certain of the Company’s loan agreements pertaining to the borrowings from the Prudential Insurance Company of America (“Prudential”) and First Florida Bank (“First Florida”) require the Company to maintain minimum interest coverage ratio, working capital, and net worth levels, impose restrictions on additional borrowings, and prohibit the payment of dividends. Specifically, at the end of fiscal 2005 Sunny Day must have a net worth of \($22,850,000\), working capital (on a FIFO inventory basis) must be at least \($1,300,000\), and the interest coverage ratio must be at least 1.6.

The company’s 2005 financial statements that follow show that Sunny Day Stores was not in compliance with these loan covenants at year end.

Required:

It’s late January 2006, and Prudential and First Florida have hired you to act on their behalf in negotiations with Sunny Day Stores. Both lenders want to restructure their loans to address the company’s current financial problems, and the restructured loans may require covenant changes.

Prudential and First Florida seek your advice on the type and amount of collateral to be required, revised interest rates, and possible changes to the payment schedules. In addition, the lenders have asked you to suggest new minimum net worth, working capital, and interest coverage ratios for 2006 and 2007. Specifically:

1. What type and amount of collateral do you suggest be required?

2. Should a higher interest rate be charged? Why or why not?

3. What changes would you suggest be made to the payment schedule?

4. What new minimum net worth, working capital, and interest coverage limits would you suggest the lenders set?

5. Suppose the company asked permission to resume payment of its \($0.12\) per share dividend, which was suspended in 2004. What advice would you give Prudential and First Florida?

Step by Step Answer: