Suppose that the monthly log returns of GE stock, measured in percentages, follow a smooth threshold GARCH(1,1)

Question:

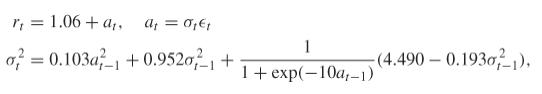

Suppose that the monthly log returns of GE stock, measured in percentages, follow a smooth threshold GARCH(1,1) model. For the sampling period from January 1926 to December 1999, the fitted model is

where all of the estimates are highly significant, the coefficient 10 in the exponent is fixed a priori to simplify the estimation, and {εt} are iid N(0,1). Assume that . What is the 1-step ahead volatility forecast ? Suppose instead that a888 = −16.0.

What is the 1-step ahead volatility forecast ?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: