Target Corporation is a general merchandise retailer. Its Target and Super target stores are part of the

Question:

Target Corporation is a general merchandise retailer. Its Target and Super target stores are part of the upscale discount chain. Wal-Mart Stores, Inc. operates retail stores in various retailing formats in all 50 states in the United States. The company's merchandising operations serve its customers primarily through the operation of three segments: the Wal-Mart stores segment includes its discount stores, Supercenters, and Neighborhood Markets in the United States; the Sam's Club segment includes the warehouse membership clubs in the United States; the international segment includes all of its operations in Argentina, Brazil, Canada, China, Japan, Germany, Korea, Mexico, Puerto Rico, and the United Kingdom.

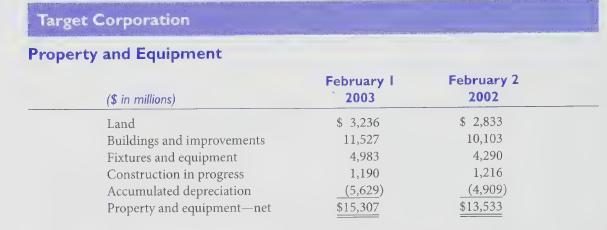

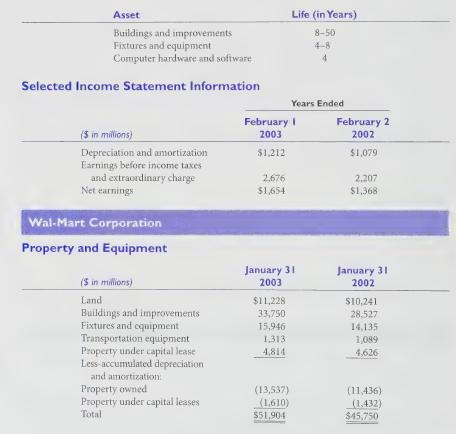

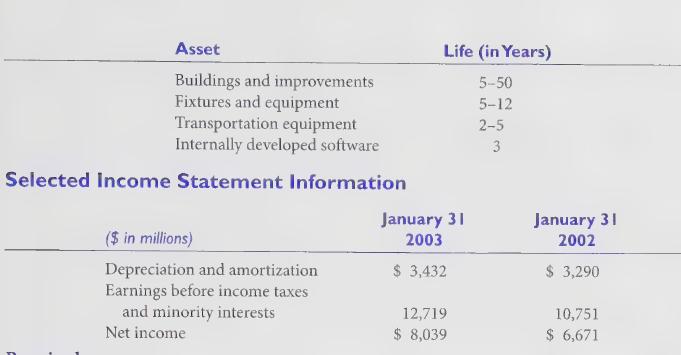

Information taken from both firms’ 2003 annual reports to shareholders follows.

Property and equipment are recorded at cost, less accumulated depreciation. Depreciation is computed using the straight-line method over estimated useful lives. Accelerated depreciation methods are generally used for income tax purposes.

Estimated useful lives by major asset category are as follows:

Depreciation and amortization for financial statement purposes are provided on the straight-line method over the estimated useful lives of the various assets. For income tax purposes, accelerated methods are used with recognition of deferred income taxes for the resulting temporary differences.

Estimated useful lives for financial statements purposes are as follows.

Required:

Assume a 35% tax rate.

1. Estimate the average useful life of each firm’s long-lived assets.

2. Calculate a revised estimate of Wal-Mart’s 2003 depreciation expense using the estimated average useful life of Target’s assets. Use this amount to recalculate Wal-Mart’s 2003 income before taxes and net income.

3. Calculate a revised estimate of Target’s 2003 depreciation expense using the estimated average useful life of Wal-Mart's assets. Use this amount to recalculate Target's 2003 income before taxes and net income.

4. Why might a financial analyst want to make the adjustments in requirements 2 and 3?

5. What factors will affect the reliability and accuracy of the adjustments performed in requirements 2 and 3?

Step by Step Answer: