The 2002 income statement of Portugal Telecom (PT) was prepared in accordance with Portuguese GAAP and reported

Question:

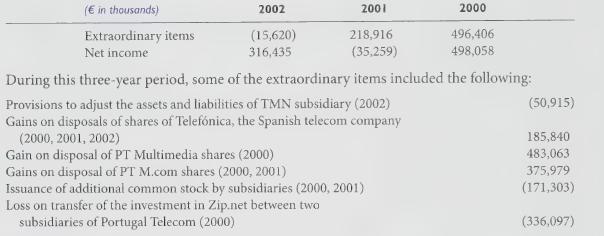

The 2002 income statement of Portugal Telecom (PT) was prepared in accordance with Portuguese GAAP and reported the following amounts for extraordinary items and net income:

Required:

1. Discuss whether each of the following would be reported as extraordinary under U.S. GAAP:

a. Provisions to adjust the assets and liabilities of a subsidiary.

b. Gains on disposal of shares of an investee.

c. Gains or losses resulting from the issuance of additional common stock by an investee.

2. Assume that you subscribe to a global data service providing only summary financial information limited to net income, total assets, and total stockholders’ equity. How does this limit your analysis of international companies?

3. The loss resulting from the transfer of one subsidiary’s investment in Zip.net to another would not have been recognized under U.S. GAAP because both subsidiaries are under the common control of Portugal Telecom. However, U.S. GAAP would have required the recognition of an impairment charge of similar magnitude because the fair value of Zip.net had declined. Would this impairment loss have been extraordinary? Explain.

Step by Step Answer: