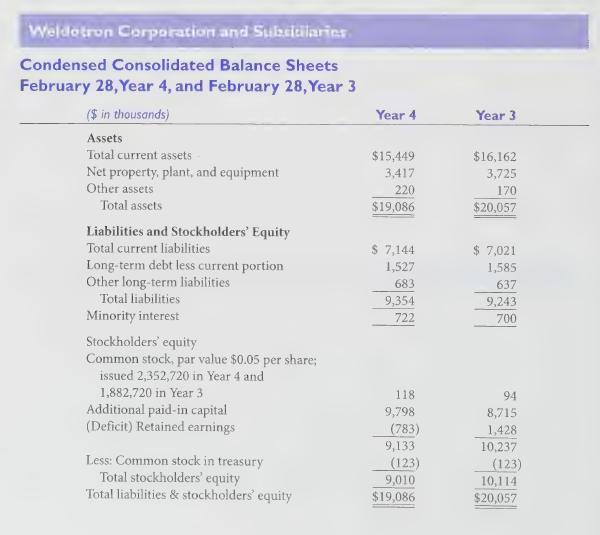

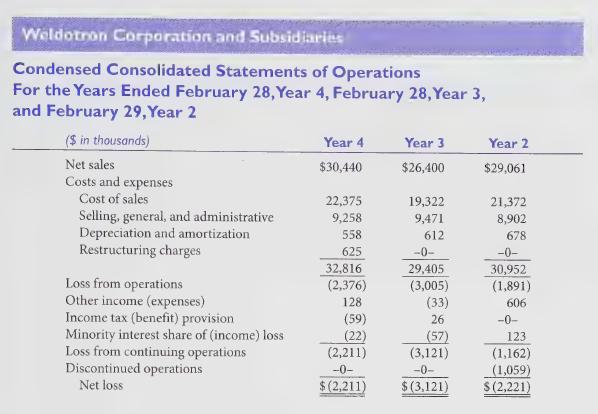

The following excerpts are taken from Weldotrons financial statements. Excerpts from footnotes ($ in thousands): 1. Summary

Question:

The following excerpts are taken from Weldotron’s financial statements.

Excerpts from footnotes ($ in thousands):

1. Summary of Significant Account Policies

Inventories: Substantially all inventories are valued at the lower of cost, determined by the use of the first in, first out method (FIFO) or market (see Note 2).

Income Taxes: Weldotron Corporation and its subsidiaries file a consolidated federal income tax return. Accumulated undistributed earnings of the Company’s foreign subsidiary were approximately \($352\) at February 28, Year 4. No provision has been made for U.S. income taxes on these earnings as the Company has reinvested or plans to reinvest overseas..

2. Change in Accounting Principle for Inventories Effective February 28, Year 4, the Company changed its basis of valuing inventories from the last in, first out (LIFO) method to the first in, first out (FIFO) method.

In previous years, the Company experienced significant operating losses and has addressed these problems by discontinuing certain products and related parts. The results of inventory reductions in previous years resulted in the liquidation of LIFO layers which resulted in a mismatching of older costs with current revenues, which defeats the primary objective of LIFO.

Further reductions of inventory levels are expected from the discontinuance of products and parts as well as better manufacturing methods which will reduce production lead times. Under these circumstances, the FIFO method of inventory valuation is the preferable method due to the improved matching of revenues and expenses and the current industry practice.

The change has been applied retroactively by restating prior years’ financial statements. The effects of the reversal of the previous LIFO reserve were partially offset by the appropriate application of FIFO costing requirements. The effects of this change in the method of valuing inventory were to increase the net loss previously reported in Year 3 by \($128\) and to decrease the net loss previously reported in Year 2 by \($97\). The effects on Year 4 were not material. The effects of this restatement were also to increase retained earnings as of March 1, Year 1, by \($2,356\).

7. Long Term Debt and Short Term Borrowings On June 25, Year 1, the Company entered into a credit facility (the “Credit Facility”) with Congress Financial Corporation (“Congress”), a CoreStates Company, to provide a revolving line of credit and term loan for working capital purposes not to exceed \($5,000\), which replaced the Company’s existing credit facility. The interest rate is 3.75% over the CoreStates floating base rate, which was 6% at February 28, Year 4. The Credit Facility further requires that the Company pay fees on the unused line of credit, for administration and on early termination of the Credit Facility..

On April 13, Year 4, the Credit Facility was extended for one year. It expires and is due and payable on or before June 25, Year 5.

The Credit Facility is collateralized by substantially all of the assets of the Company and its domestic subsidiaries. Borrowings under the Credit Facility are limited to certain percentages of eligible inventory and accounts receivable including stipulations as to the ratio of advances collateralized by receivables compared to advances collateralized by inventory.

The Credit Facility’s covenants stipulate that tangible domestic net worth of greater than \($8,200\) and consolidated working capital greater than \($9,500\) be maintained. In addition the Credit Facility restricts the payment of dividends, limits the amount of the advances to and guarantees for the Company’s foreign subsidiary and limits annual capital expenditures to \($500\). At February 28, Year 4, the Company was in compliance with the covenants of the Credit Facility.

Borrowings under the Credit Facility aggregated \($3,215\), including a \($1,500\) long-term loan at February 28, Year 4. The remaining borrowing under the Credit Facility is included in current liabilities.

Tax Note At February 28, Year 4, \($8,400\) of Federal tax loss carryforwards are available for regular income tax purposes.

Note 2 states that Weldotron changed its inventory method from LIFO to FIFO effective February 28, Year 4. In the same note, the Company has provided justifications for the change in the inventory cost flow assumption. Note 7 discloses details of the Company’s credit facility and covenants. This note states that the Company was in compliance with the covenants on February 28, Year 4.

Required:

Financial reporting choices can sometimes allow companies to achieve strategic objectives and benefit shareholders. Using this perspective, evaluate the effect of Weldotron’s inventory accounting change on its debt covenants, specifically on the tangible domestic net worth constraint of \($8,200\) and the consolidated working capital constraint of \($9,500\). (Note: In answering this question, you should keep in mind that when applying the working capital constraint, lenders often ignore current liabilities related to the borrowing itself.)

Step by Step Answer: