The following information appeared in the 2002 annual report of Lyondell Petrochemical Company, a manufacturer of petrochemicals

Question:

The following information appeared in the 2002 annual report of Lyondell Petrochemical Company, a manufacturer of petrochemicals and refined petroleum products such as gasoline, heating oil, jet fuel, aromatics, and lubricants:

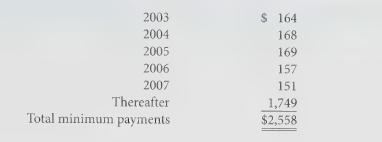

The Company is party to various unconditional purchase obligation contracts as a purchaser for products and services, principally for steam and power. At December 31, 2002, future minimum payments under these contracts with noncancelable contract terms in excess of one year and fixed minimum payments were as follows ($ in millions):

Required:

1. Suppose that the company were obligated to purchase \($349.8\) million per year in 2008 and each of the next four years for a total of \($1,749.\) If Lyondell’s normal rate of interest for a 10-year loan is 8%, what is the present value of the company’s purchase commitments?

2. The company’s 2002 balance sheet shows long-term debt of \($3,926\) million and shareholders’ equity of \($1,179\) million. The unconditional purchase obligation is not shown on the balance sheet. What impact would including the present value of unconditional purchase obligations as part of long-term debt have on the company’s 2002 ratio of long-term debt to shareholders’ equity?

3. Why are unconditional purchase obligations an off-balance-sheet liability? Why might some companies prefer to keep the purchase commitment off the balance sheet?

Step by Step Answer: