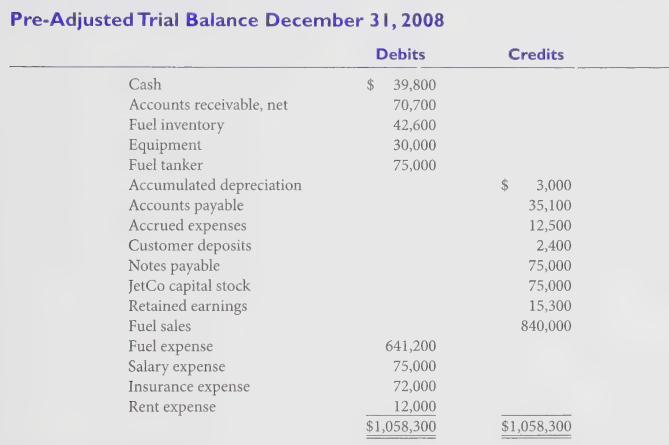

The following is the pre-adjusted trial balance of JetCo Fuel Services as of December 31, 2008. Additional

Question:

The following is the pre-adjusted trial balance of JetCo Fuel Services as of December 31, 2008.

Additional Information:

a. A fuel tanker was purchased July 1, 2008 by issuing a three-year 10% interest-bearing note payable for \($75,000\). The tanker is expected to last 10 years and then be scrapped. JetCo uses the straight-line depreciation method.

b. After taking a physical inventory, it was discovered that fuel inventories were overstated by \($6,100.

c.\) Equipment on the balance sheet was acquired January 1, 2007 and has a 10-year life.

d. A search of unrecorded liabilities reveals unrecorded fuel expenses of \($4,800.

e.\) A 36-month insurance policy was acquired for \($72,000\) on August 31, 2008, and charged to Insurance expense.

f. On June 1, 2008, one-year’s rent (\($12,000)\) was paid and charged to rent expense.

g. The balance in the Customer deposits account was earned in 2008.

h. During 2008, JetCo paid a dividend of \($75,000,\) which was subtracted from Retained

earnings.

Required:

1. Prepare any required adjustments as of December 31, 2008.

2. Prepare JetCo’s income statement for the year ending 2008 and its balance sheet.

Step by Step Answer: