The following was excerpted from The Wall Street Journal Online: The Dallas technology outsourcer [Affiliated Computer Services]

Question:

The following was excerpted from The Wall Street Journal Online:

The Dallas technology outsourcer [Affiliated Computer Services] acknowledged Mayaf 10, after a preliminary internal probe, that it had issued executive stock options that carried “effective dates” preceding the written approval of the grants. ACS said it plans a charge of as much as

\($32\) million to rectify its accounting related to the grants. It is being examined by the Securities and Exchange Commission. On Aug. 7, the company announced that investors should no longer rely on its prior disclosures about the findings of its continuing internal probe. It had previously said a preliminary review suggested no intentional backdating occurred and any charges were likely to be minor. Noncash compensation costs related to backdating will be about \($51\) million, plus additional tax-related expenses.

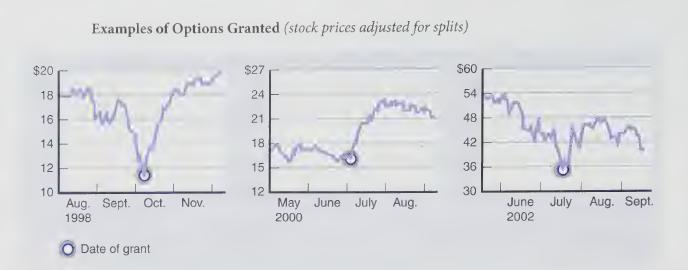

Certain executives have repeatedly received stock options on favorable dates—just ahead of sharp gains in the price of the company stock. Below [are shown] the number of option grants [Jeffrey Rich, ACS former chief executive] received between roughly 1995 and 2002 and the odds—by a Wall Street Journal analysis—that such a favorable pattern of grants would occur by chance. Charts show three especially propitious grants to [Mr. Rich], and what the stock did two months before the grant and two months after.

Total grants: 6 Odds: About 1 in 300 billion

Company’s Response at Date of Publication (March 18, 2006)

Mr. Rich said no grants were backdated, called his favorable dates “blind luck.” Company spokeswoman said, “We did grant options when there was a natural dip in the stock price.” Mr. Rich stepped down as chief executive last fall.

Required:

Visit the SEC’s Web site (www.sec.gov) and retrieve ACS’s form 10-K/A for the fiscal year that ended June 30, 2006. Read footnote 2 to the financial statements entitled “Review of Stock Option Grant Practices,” and then address the following:

1. ACS conducted an internal investigation into its stock options-granting practices. What did this investigation reveal?

2. Locate the tables (toward the end of footnote 2) that reflect options-related adjustments to ACS’s consolidated financial statements.

a. What financial statements were affected, and in what manner, by ACS’s options granting practices?

b. Re-create the journal entry that ACS made to restate the company’s balance sheet at June 30, 2005.

Step by Step Answer: