The inventory footnote to the 2008 annual report of Ruedy Company reads in part as follows: Because

Question:

The inventory footnote to the 2008 annual report of Ruedy Company reads in part as follows:

Because of a prolonged strike in one of our supplier's plants, inventories were unavoidably reduced during 2008. Under the LIFO system of accounting, this “eating into LIFO layers” resulted in an increase in after-tax net income of $36,000 over what it would have been had inventories been maintained at their physical levels that existed at the start of the year.

The price of Ruedy’s merchandise purchases was $22 per unit for 20,000 units during 2008.

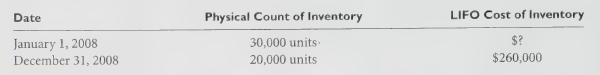

Prior to 2008, inventory prices had risen steadily for many years. Ruedy uses the periodic inventory method. A summary of its inventory positions at the beginning and end of the year follow. Ruedy’s income tax rate is 40%.

Required:

1. Was 2008 cost of goods sold higher or lower as a result of the LIFO liquidation? By how much?

2. Were 2008 income taxes higher or lower as a result of eating into LIFO layers? By how much?

3. What was the average cost per unit of the 10,000 units removed from the January 1, 2008 LIFO inventory?

4. What was the January 1, 2008, LIFO cost of inventory?

5. What was the reported 2008 cost of goods sold for Ruedy Company?

Step by Step Answer: