A decomposition of ROE for Company A and Company B is as follows: An analyst is most

Question:

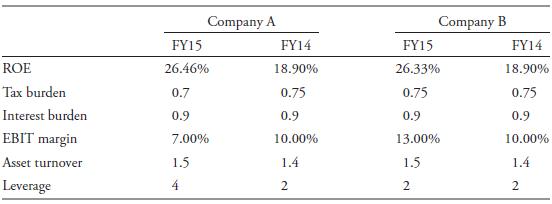

A decomposition of ROE for Company A and Company B is as follows:

An analyst is most likely to conclude that:

A. Company A’s ROE is higher than Company B’s in FY15, and one explanation consistent with the data is that Company A may have purchased new, more efficient equipment.

B. Company A’s ROE is higher than Company B’s in FY15, and one explanation consistent with the data is that Company A has made a strategic shift to a product mix with higher profit margins.

C. The difference between the two companies’ ROE in FY15 is very small and Company A’s ROE remains similar to Company B’s ROE mainly due to Company A increasing its financial leverage.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie