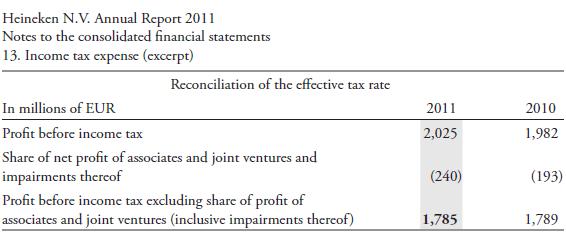

Below are excerpts from the effective tax rate reconciliation disclosures by two companies: Heineken N.V., a Dutch

Question:

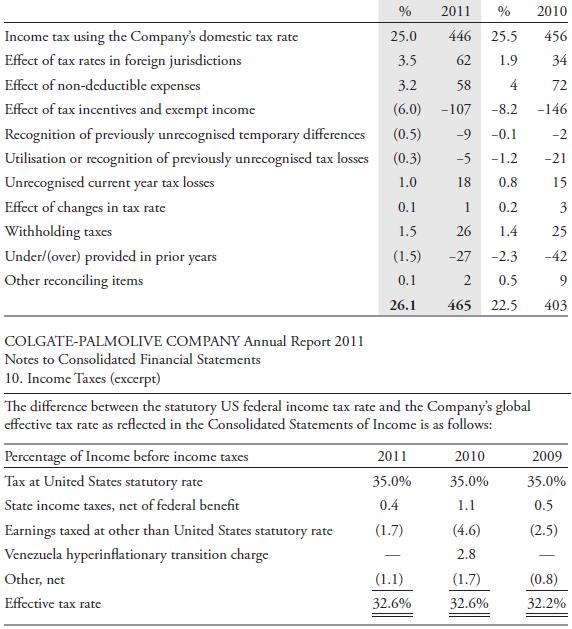

Below are excerpts from the effective tax rate reconciliation disclosures by two companies:

Heineken N.V., a Dutch brewer, and Colgate Palmolive, a US consumer products company. Use the disclosures to answer the following questions:

1. Which company’s home country has a lower statutory tax rate?

2. What was the impact of multinational operations on each company’s 2011 effective tax rate?

3. Changes in the tax rate impact of multinational operations can often be explained by changes of profit mix between countries with higher or lower marginal tax rates. What do Heineken’s disclosures suggest about the geographic mix of its 2011 profit?

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie