If the valuation allowance had been the same in 2007 as it was in 2006, the company

Question:

If the valuation allowance had been the same in 2007 as it was in 2006, the company would have reported $115 higher :

A. net income.

B. deferred tax assets.

C. income tax expense.

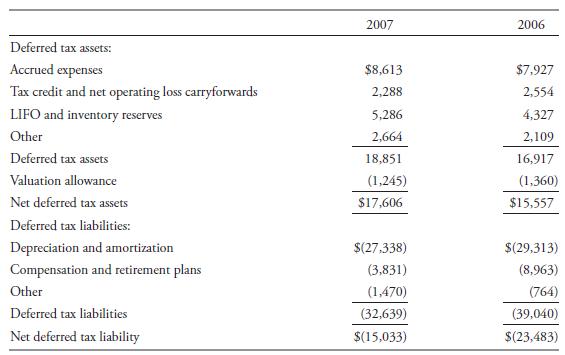

The tax effects of temporary differences that give rise to deferred tax assets and liabilities are as follows ($ thousands):

Transcribed Image Text:

Deferred tax assets: Accrued expenses Tax credit and net operating loss carryforwards LIFO and inventory reserves Other Deferred tax assets Valuation allowance Net deferred tax assets Deferred tax liabilities: Depreciation and amortization Compensation and retirement plans Other Deferred tax liabilities Net deferred tax liability 2007 $8,613 2,288 5,286 2,664 18,851 (1,245) $17,606 $(27,338) (3,831) (1,470) (32,639) $(15,033) 2006 $7,927 2,554 4,327 2,109 16,917 (1,360) $15,557 $(29,313) (8,963) (764) (39,040) $(23,483)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

The question is asking what the impact on the financial statements would be if the valuation allowan...View the full answer

Answered By

Charles mwangi

I am a postgraduate in chemistry (Industrial chemistry with management),with writing experience for more than 3 years.I have specialized in content development,questions,term papers and assignments.Majoring in chemistry,information science,management,human resource management,accounting,business law,marketing,psychology,excl expert ,education and engineering.I have tutored in other different platforms where my DNA includes three key aspects i.e,quality papers,timely and free from any academic malpractices.I frequently engage clients in each and every step to ensure quality service delivery.This is to ensure sustainability of the tutoring aspects as well as the credibility of the platform.

4.30+

2+ Reviews

10+ Question Solved

Related Book For

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie

Question Posted:

Students also viewed these Business questions

-

a) This question places you in the position of a computer network manager required to develop an IPv4 addressing scheme for the VLAN part of the topology given in Figure 1, fulfilling all...

-

Macy's, Inc., reported the following in its 2017 annual report: On December 22, 2017, H.R. 1 was enacted into law. This new tax legislation, among other things, reduced the U.S. federal corporate tax...

-

A reduction in the statutory tax rate would most likely benefit the companys: A. income statement and balance sheet. B. income statement but not the balance sheet. C. balance sheet but not the income...

-

A molecule with the molecular formula C11H12N2O2 (relative molecular mass = 204.23) crystallized to form monoclinic crystals with a=18.899 , b=5.7445 , and c=9.309 , with =101.776. The crystal...

-

A perpetual preferred stock position pays quarterly dividends of $1,000 indefinitely (forever). If an investor has a required rate of return of 12 percent per year compounded quarterly on this type...

-

What is the Malcolm Baldrige National Quality Award? LO.1

-

What is the difference between make to order and assemble to order? Give an example of each. LO.1

-

Selected account balances at December 31, 2014, for Infosys Company follow. Prepare a multistep income statement for the year ended December 31, 2014. Show detail of net sales. The company uses the...

-

nanswered Save LA4 The following balances are recorded in Miller Corp's trial balance before adjustments: Accounts Receivable. $150,000 debit Allowance for Doubtful Accounts. $850 credit Sales...

-

Compared to the provision for income taxes in 2007, the companys cash tax payments were: A. lower. B. higher. C. the same. The tax effects of temporary differences that give rise to deferred tax...

-

Cinnamon, Inc. recorded a total deferred tax asset in 2007 of $12,301, off set by a $12,301 valuation allowance. Cinnamon most likely : A. fully utilized the deferred tax asset in 2007. B. has an...

-

What are the typical causes of projects that are over budget? Were the causes of cost overruns on the Big Dig typical of most projects, unique to large-scale megaprojects, or unique only to the Big...

-

Locate a scholarly article relevant to how to present your financial plan for opening a Roller Skating Rink (from your draft business plan) to a lending institution--and describe your strategy for...

-

How would you expect seasonal fluctuations in demand to affect a rental company's decisions about pricing rented products such as wedding dresses or convertible cars? In terms of pricing principles,...

-

Do we drive technology, or does technology drive us? If technology drives us, what are the risks? The other side of the coin would be that we are able to stay ahead of technological transformations....

-

How do you explain the differences between the two analyses and what are the implications of using the BCG matrix in practice?

-

How do leadership styles, such as transformational leadership, shared leadership, and servant leadership, impact team dynamics, member motivation, and overall team effectiveness ?

-

While walking from the car into your dormitory, you dropped your engagement ring somewhere in the snow. The path is straight and 30 feet long. You are distraught because the density of its location...

-

The MIT Sloan School of Management is one of the leading business schools in the U.S. The following table contains the tuition data for the masters program in the Sloan School of Management. a. Use...

-

Eleanors Computers is a retailer of computer products. Using the financial data provided, complete the financialratio calculations for 2016. Advise management of any ratios that indicate potential...

-

In analyzing the financial statements of a firm, what is management looking to find?

-

What does a financial leverage index greater than one indicate about a firm? (a) The unsuccessful use of financial leverage. (b) Operating returns more than sufficient to cover interest payments on...

-

Break-Even Sales and Sales to Realize Income from Operations For the current year ending October 31, Yentling Company expects fixed costs of $537,600, a unit variable cost of $50, and a unit selling...

-

You buy a stock for $35 per share. One year later you receive a dividend of $3.50 per share and sell the stock for $30 per share. What is your total rate of return on this investment? What is your...

-

Filippucci Company used a budgeted indirect-cost rate for its manufacturing operations, the amount allocated ($200,000) is different from the actual amount incurred ($225,000). Ending balances in the...

Study smarter with the SolutionInn App