In 2009, Cinnamons earnings before taxes includes a contribution (in millions) from its investment in Cambridge

Question:

In 2009, Cinnamon’s earnings before taxes includes a contribution (in £ millions) from its investment in Cambridge Processing that is closest to:

A. £3.8.

B. £5.8.

C. £7.6.

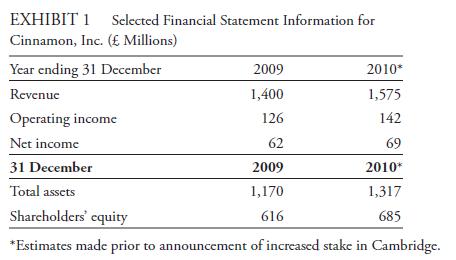

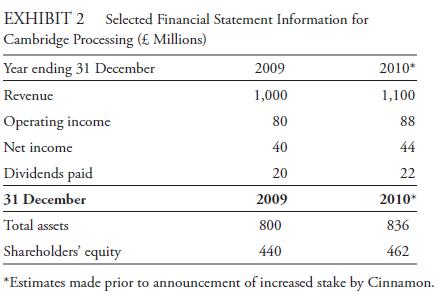

Cinnamon, Inc. is a diversified manufacturing company headquartered in the United Kingdom. It complies with IFRS. In 2009, Cinnamon held a 19 percent passive equity ownership interest in Cambridge Processing that was classified as available-for-sale. During the year, the value of this investment rose by £2 million. In December 2009, Cinnamon announced that it would be increasing its ownership interest to 50 percent effective 1 January 2010 through a cash purchase. Cinnamon and Cambridge have no intercompany transactions.

Peter Lubbock, an analyst following both Cinnamon and Cambridge, is curious how the increased stake will affect Cinnamon’s consolidated financial statements. He asks Cinnamon’s CFO how the company will account for the investment, and is told that the decision has not yet been made. Lubbock decides to use his existing forecasts for both companies’ financial statements to compare the outcomes of alternative accounting treatments.

Lubbock assembles abbreviated financial statement data for Cinnamon (Exhibit 1) and Cambridge (Exhibit 2) for this purpose.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie