In August 2012, a Wall Street Journal article listed six companies that were carrying more goodwill on

Question:

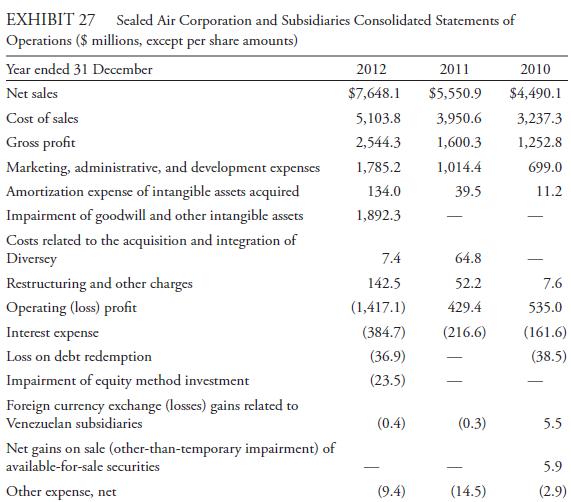

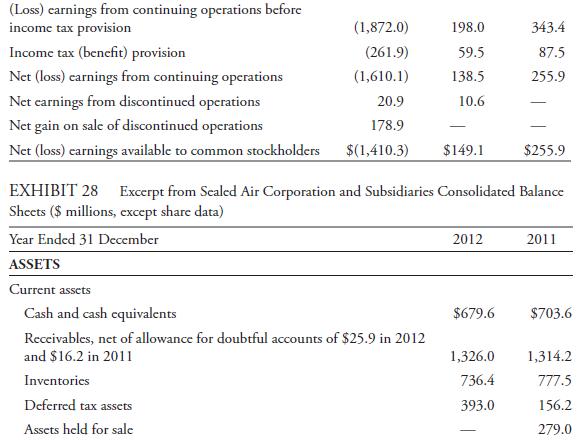

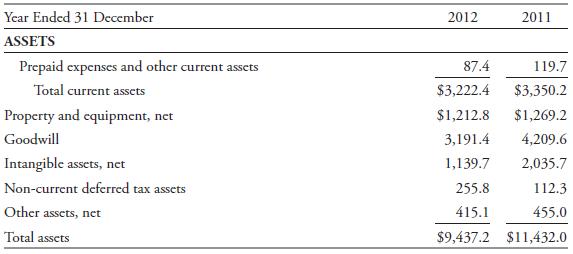

In August 2012, a Wall Street Journal article listed six companies that were carrying more goodwill on their balance sheets than the companies’ market values ( Thurm 2012 ). At the top of the list was Sealed Air Corporation (NYSE: SEE), a company operating in the packaging and containers industry. Exhibit 27 presents an excerpt from the company’s income statement for the following year, and Exhibit 28 presents an excerpt from the company’s balance sheet.

1. SEE’s financial statements indicate that the number of common shares issued and outstanding in 2011 was 192,062,185. The price per share of SEE’s common stock was around $18 per share in December 2011 and around $14 in August 2012; the Wall Street Journal article ( Th urm 2012 ) was written in 2012. What was the company’s market value?

2. How did the amount of goodwill as of 31 December 2011 compare with the company’s market value?

3. Why did the Wall Street Journal article state that goodwill in excess of the company’s market value is “a potential clue to future write-off s”?

4. Based on the information in Exhibit 28 , does the Wall Street Journal article statement appear to be correct?

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie