In the process of comparing the 2009 performance of three telecommunication companiesTelfonos de Mxico, S.A.B. DE C.V.

Question:

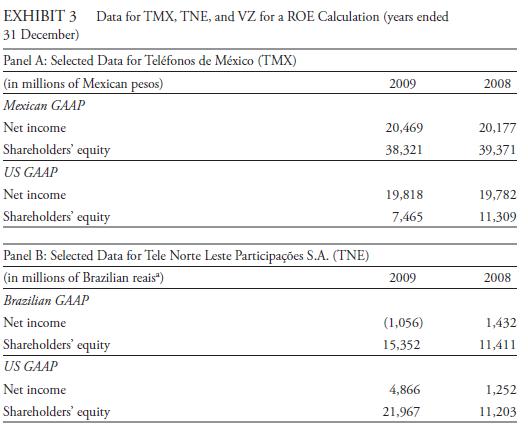

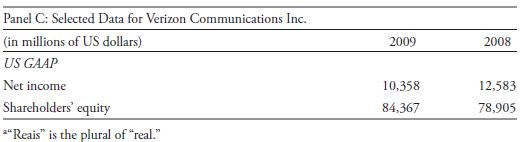

In the process of comparing the 2009 performance of three telecommunication companies—Teléfonos de México, S.A.B. DE C.V. (NYSE: TMX), Tele Norte Leste Participações S.A. (NYSE: TNE), and Verizon Communications Inc. (NYSE: VZ)—an analyst prepared Exhibit 3 to evaluate whether the differences in accounting standards affect the comparison of the three companies’ return on equity (ROE). Panel A presents selected data for TMX for 2008 and 2009 under Mexican GAAP and US GAAP. Panel B presents data for TNE under Brazilian GAAP and US GAAP. Panel C presents data for VZ under US GAAP.

Based on TMX’s reconciliation footnote, the most significant adjustment for TMX between Mexican GAAP and US GAAP was an adjustment to shareholders’ equity for “Labor obligations (SFAS 158).” The US accounting standard SFAS 158, Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans , now codified as Accounting Standards Codification (ASC) 715 (i.e., Expenses: Compensation– Retirement Benefits) requires companies to reflect on their balance sheets the funded status of pensions and other post-employment benefits. (Funded status equals plan assets minus plan obligations.) For an underfunded plan—i.e., one in which assets that are held in trust to pay for the obligation are less than the amount of the obligation—the amount of underfunding is shown as a liability and as a reduction to shareholders’ equity. [The full reconciliation between shareholders’ equity under Mexican FRS and US GAAP (not presented here) shows that the adjustment related to SFAS 158 reduced equity at TMX by 50,028 million pesos and 46,637 million pesos in 2009 and 2008, respectively.]

Based on TNE’s reconciliation footnote, the most significant adjustment for TNE between Brazilian GAAP and US GAAP was an increase to net income to recognize a “bargain purchase gain on business combination.” A bargain purchase gain under US GAAP results when the purchase price of an acquisition is less than the fair value (as of the acquisition date) of the net identified assets acquired. The adjustment for the bargain purchase gain represented an increase of 6,591 million Brazilian reais to net income as reported under Brazilian GAAP.

Does the difference in accounting standards affect the ROE comparison?

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie