Nokia Corporation (NASDAQ OMX Helsinki and NYSE:NOK), a global telecommunications company headquartered in Finland, operates three businesses:

Question:

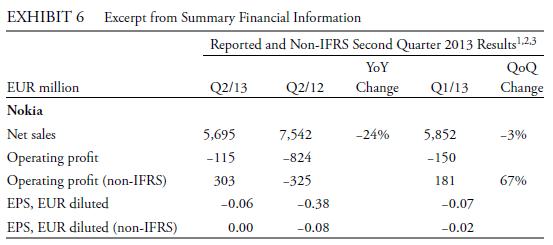

Nokia Corporation (NASDAQ OMX Helsinki and NYSE:NOK), a global telecommunications company headquartered in Finland, operates three businesses: Devices & Services, HERE (the new brand for location and mapping services, formerly called Location & Commerce), and Nokia Siemens Networks. Exhibit 6 presents an excerpt from the company’s Interim Report for the second quarter ending June 2013.

The following excerpt explains the term “non-IFRS.”

Note 1 relating to non-IFRS (also referred to as “underlying”) results:

In addition to information on our reported IFRS results, we provide certain information on a non-IFRS, or underlying business performance, basis.

Non-IFRS results exclude all material special items for all periods. In addition, non-IFRS results exclude intangible asset amortization, other purchase price accounting related items and inventory value adjustments arising from

(i) the formation of Nokia Siemens Networks

(ii) all business acquisitions completed after June 30, 2008.

Nokia believes that our non-IFRS results provide meaningful supplemental information to both management and investors regarding Nokia’s underlying business performance by excluding the above-described items that may not be indicative of Nokia’s business operating results. These non-IFRS financial measures should not be viewed in isolation or as substitutes to the equivalent IFRS measure(s), but should be used in conjunction with the most directly comparable IFRS measure(s)

in the reported results. See note 2 below for information about the exclusions from our non-IFRS results. More information, including a reconciliation of our Q2 2013 and Q2 2012 non-IFRS results to our reported results, can be found. . . .

In an excerpt from Note 2, the company also disclosed the following.

Note 2 relating to non-IFRS exclusions:

Q2 2013—EUR 418 million (net) consisting of:

• EUR 157 million restructuring charge and other associated items in Nokia Siemens Networks.

• EUR 151 million losses related to divestments of businesses in Nokia Siemens Networks.

• EUR 10 million restructuring charge in HERE.

• EUR 12 million of intangible asset amortization and other purchase price accounting related items arising from the acquisition of Motorola Solutions’ networks assets.

• EUR 87 million of intangible asset amortization and other purchase price accounting related items arising from the acquisition of NAVTEQ.

• EUR 1 million of intangible assets amortization and other purchase price accounting related items arising from the acquisition of Novarra, MetaCarta and Motally in Devices & Services.

Note 3 related to changes to historical comparative financial results due to revised IFRS accounting standard, IAS 19 Employee benefits.

1. Based on the information provided, explain the differences between the following two disclosures contained in Nokia’s interim statement:

A. The first page of the interim report includes the following statement as a second-

quarter 2013 highlight: “Nokia Group achieved underlying operating profitability for the fourth consecutive quarter, with a Q2 non-IFRS operating margin of 5.3% . . . .”

B. Nokia’s Consolidated Income Statements (found on page 20 of the interim report)

report a EUR278 million net loss.

2. How does the heading “Q2 2013—EUR418 million” from Nokia’s Note 2 correspond with the excerpt from the company’s Summary Financial Information shown in Exhibit 6 ?

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie