On 1 January 2011, Parker Company acquired 30% of Prince Inc. common shares for the cash price

Question:

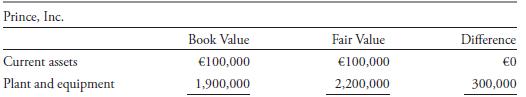

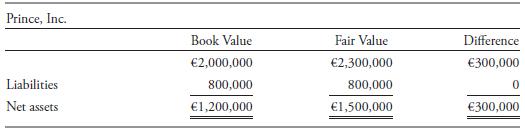

On 1 January 2011, Parker Company acquired 30% of Prince Inc. common shares for the cash price of €500,000 (both companies are fictitious). It is determined that Parker has the ability to exert significant influence on Prince’s financial and operating decisions. The following information concerning Prince’s assets and liabilities on 1 January 2011 is provided:

Th e plant and equipment are depreciated on a straight-line basis and have 10 years of remaining life. Prince reports net income for 2011 of €100,000 and pays dividends of €50,000. Calculate the following:

1. Goodwill included in the purchase price.

2. Investment in associate (Prince) at the end of 2011.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie