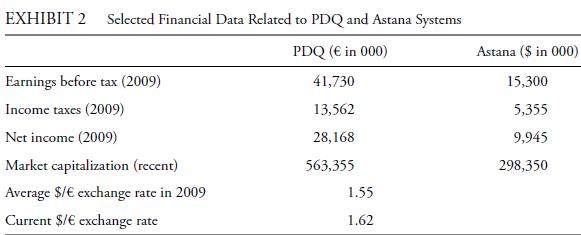

The estimate of PDQs solo value is crude because of: A. the potential differences in accounting standards

Question:

The estimate of PDQ’s solo value is crude because of:

A. the potential differences in accounting standards used by PDQ and Astana.

B. the differing risk characteristics of PDQ and Astana.

C. differences in liquidity and market efficiency where PDQ and Astana trade.

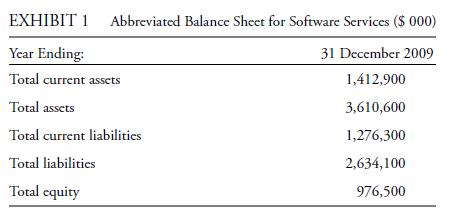

Michael Wetstone is an equity analyst covering the software industry for a public pension fund. Prior to comparing the financial results of Software Services Inc. and PDQ GmbH, Wetstone discovers the need to make adjustments to their respective financial statements. The issues preventing comparability, using the financial statements as reported, are the sale of receivables and the impact of minority interests. Software Services sold $267.5 million of finance receivables to a special purpose entity.

PDQ does not securitize finance receivables. An abbreviated balance sheet for Software Services is presented in Exhibit 1.

A significant portion of PDQ’s net income is explained by its 20 percent minority interest in Astana Systems. Wetstone collects certain data (Exhibit 2) related to both PDQ and Astana in order to estimate the financials of PDQ on a stand-alone basis.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie