Which component of Kensingtons periodic pension cost would be shown in OCI rather than P&L? A. Service

Question:

Which component of Kensington’s periodic pension cost would be shown in OCI rather than P&L?

A. Service cost

B. Net interest (income) expense

C. Remeasurements

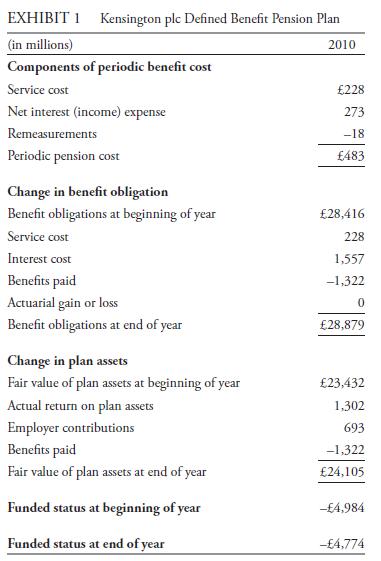

Kensington plc, a hypothetical company based in the United Kingdom, offers its employees a defined benefit pension plan. Kensington complies with IFRS. The assumed discount rate that the company used in estimating the present value of its pension obligations was 5.48 percent. Information on Kensington’s retirement plans is presented in Exhibit 1.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie

Question Posted: