With respect to Statement 2, what would be the most likely effect in 2010 if AMRC were

Question:

With respect to Statement 2, what would be the most likely effect in 2010 if AMRC were to switch to an accelerated depreciation method for both financial and tax reporting?

A. Net profit margin would decrease.

B. Total asset turnover would increase.

C. Cash flow from operating activities would increase.

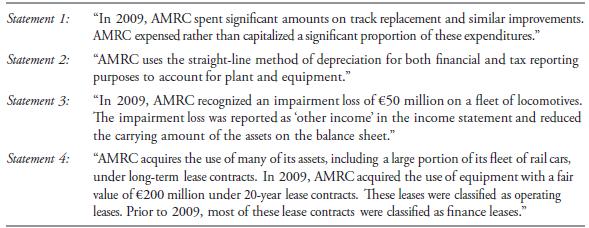

Melanie Hart, CFA, is a transportation analyst. Hart has been asked to write a research report on Altai Mountain Rail Company (AMRC). Like other companies in the railroad industry, AMRC’s operations are capital intensive, with significant investments in such long-lived tangible assets as property, plant, and equipment. In November of 2008, AMRC’s board of directors hired a new team to manage the company. In reviewing the company’s 2009 annual report, Hart is concerned about some of the accounting choices that the new management has made. These choices differ from those of the previous management and from common industry practice. Hart has highlighted the following statements from the company’s annual report:

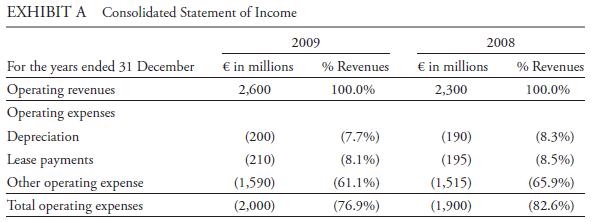

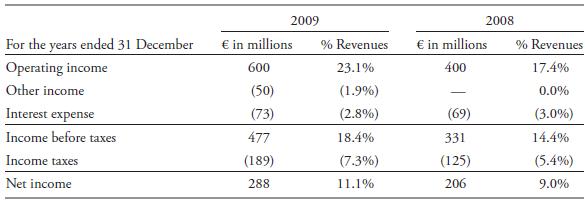

Exhibits A and B contain AMRC’s 2009 consolidated income statement and balance sheet. AMRC prepares its financial statements in accordance with International Financial Reporting Standards.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie