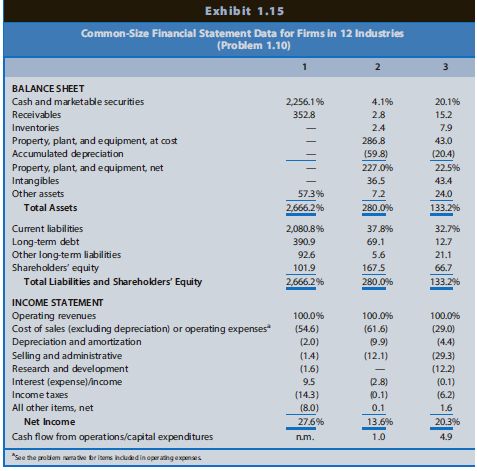

Effective financial statement analysis requires an understanding of a firms economic characteristics. The relations between various financial

Question:

A. Abercrombie & Fitch: Sells retail apparel primarily through stores to the fashion-conscious young adult and has established itself as a trendy, popular player in the specialty retailing apparel industry.

B. Allstate Insurance: Sells property and casualty insurance, primarily on buildings and automobiles. Operating revenues include insurance premiums from customers and revenues earned from investments made with cash received from customers before Allstate pays customers€™ claims. Operating expenses include amounts actually paid or expected to be paid in the future on insurance coverage outstanding during the year.

C. Best Buy: Operates a chain of retail stores selling consumer electronic and entertainment equipment at competitively low prices.

D. 3M: Manufactures a wide variety of industrial and consumer products (the firm lists 45 product categories on its website), ranging from home, office, and school products (such as Post-it Notes and Scotch Tape), to wound and skin care (such as Ace bandages), to adhesives for the aerospace and aircraft industries.

E. Hewlett-Packard: Develops, manufactures, and sells computer hardware. The firm outsources manufacturing of many of its computer components.

F. HSBC Finance: Lends money to consumers for periods ranging from several months to several years. Operating expenses include provisions for estimated uncollectible loans (bad debts expense).

G. Kelly Services: Provides temporary office services to businesses and other firms. Operating revenues represent amounts billed to customers for temporary help services, and operating expenses include amounts paid to the temporary help employees of Kelly.

H. McDonald€™s: Operates fast-food restaurants worldwide. A large percentage of McDonald€™s restaurants are owned and operated by franchisees. McDonald€™s frequently owns the restaurant buildings of franchisees and leases them to franchisees under long-term leases.

I. Merck: A leading research-driven pharmaceutical products and services company. Merck discovers, develops, manufactures, and markets a broad range of products to improve human and animal health directly and through its joint ventures.

J. Omnicom Group: Creates advertising copy for clients and is the largest marketing services firm in the world. Omnicom purchases advertising time and space from various media and sells it to clients. Operating revenues represent commissions and fees earned by creating advertising copy and selling media time and space. Operating expenses include employee compensation.

K. Pacific Gas & Electric: Generates and sells power to customers in the western United States.

L. Procter & Gamble: Manufactures and markets a broad line of branded consumer products.

REQUIRED

Use the ratios to match the companies in Exhibit 1.16 with the firms listed above, and explain your reasoning using the strategy framework in the chapter.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

ISBN: 1711

9th Edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Question Posted: