Question:

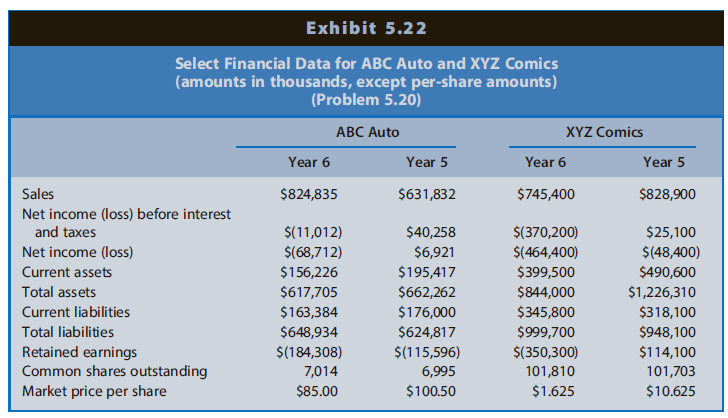

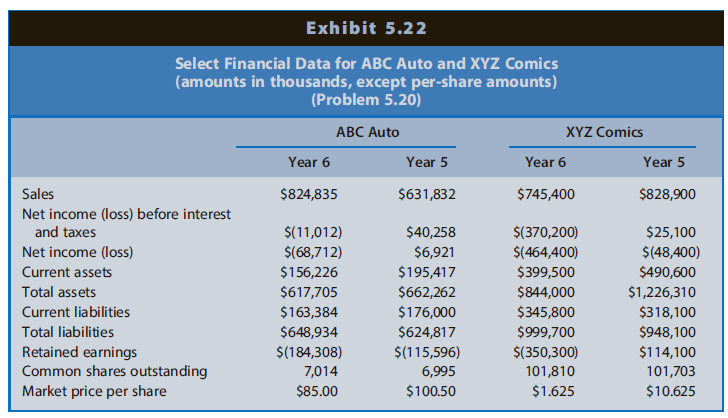

Exhibit 5.22 presents selected financial data for ABC Auto and XYZ Comics for fiscal Year 5 and Year 6. ABC Auto manufactures automobile components that it sells to automobile manufacturers. Competitive conditions in the automobile industry in recent years have led automobile manufacturers to put pressure on suppliers such as ABC Auto to reduce costs and selling prices. XYZ Comics creates and sells comic books, trading cards, and other youth entertainment products and licenses others to use fictional characters created by XYZ Comics in their products. Youth readership of comic books and interest in trading cards have been declining steadily in recent years. XYZ Comics recognized a significant asset impairment charge in fiscal Year 6.

REQUIRED

a. Compute Altman€™s Z-score for ABC Auto and XYZ Comics for fiscal Year 5 and Year 6.

b. How did the bankruptcy risk of ABC Auto change between fiscal Year 5 and Year 6? Explain.

c. How did the bankruptcy risk of XYZ Comics change between Year 5 and Year 6? Explain.

d. Which firm is more likely to file for bankruptcy during fiscal Year 7? Explain using the analyses from Requirement b.

Transcribed Image Text:

Exhibit 5.22 Select Financial Data for ABC Auto and XYZ Comics (amounts in thousands, except per-share amounts) (Problem 5.20) XYZ Comics ABC Auto Year 5 Year 6 Year 5 Year 6 Sales $824,835 $631,832 $745,400 $828,900 Net income (loss) before interest and taxes $(11,012) $40,258 $(370,200) $25,100 Net income (loss) $(68,712) $6,921 $(464,400) $(48,400) Current assets $156,226 $195,417 $399,500 $490,600 Total assets $617,705 $662,262 $176,000 $844,000 $1,226,310 Current liabilities $163,384 $345,800 $318,100 Total liabilities $648,934 $624,817 $999,700 $948,100 Retained earnings Common shares outstanding Market price per share $(184,308) $(115,596) $(350,300) $114,100 7,014 6,995 101,810 101,703 $100.50 $85.00 $1.625 $10.625