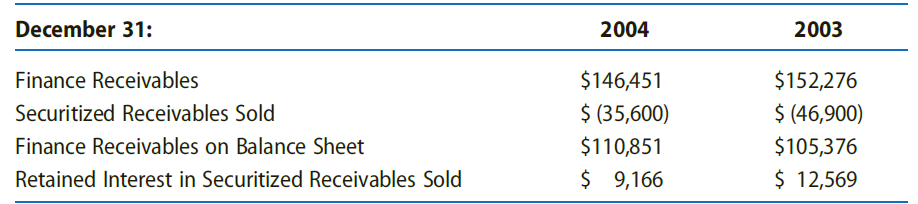

Ford Motor Credit Company discloses the following information with respect to finance receivables (amounts inmillions). Notes to

Question:

Notes to Financial Statements

The Company periodically sells finance receivables in securitization transactions to fund operations and to maintain liquidity. The securitization process involves the sale of interest-bearing securities to investors, the payment of which is secured by a pool of receivables. In many securitization transactions, the Company surrenders control over certain of its finance receivables by selling these assets to SPEs. SPEs then securitize the receivables by issuing certificates representing undivided interests in the SPEs' assets to outside investors and to the Company (retained interest). These certificates entitle the holder to a series of scheduled cash flows under present terms and conditions, the receipt of which is dependent upon cash flows generated by the related SPEs' assets. The cash flows on the underlying receivables are used to pay principal and interest on the debt securities as well as transaction expenses.

In each securitization transaction, the Company retains certain subordinated interests in the SPE, which are the first to absorb credit losses on the sold receivables. As a result, the credit quality of certificates held by outside investors is enhanced. However, the investors and the trusts have no recourse against the Company beyond the trust assets. The Company also retains the servicing rights to the sold receivables and receives a servicing fee. While servicing the sold receivables for the SPE, the Company applies the same servicing policies and procedures that it applies to its own receivables and maintains a normal relationship with its financing customers.

REQUIRED

a. Applying the criteria for the sale of receivables, justify Ford Motor Credit's treatment of the securitization of finance receivables on December 31, 2003 and 2004, as a sale instead of a collateralized loan.

b. Assume that the receivables disclosed as securitized on December 31, 2003, had been initially securitized on that day. Give the journal entry that Ford Motor Credit would have made to securitize these receivables, assuming that it securitized the receivables at no gain or loss.

c. Assume that Ford Motor Credit decided to consolidate its receivables securitization structure in 2004 and to start accounting for it as secured borrowings. Give the journal entry that the company would make on December 31, 2004, to account for this change, assuming that it recognized no gain or loss on this event.

d. Most firms prefer to report the securitization of receivables as a sale. The alternative is to view the arrangement as a collateralized loan with the receivables remaining on the firm's balance sheet. Speculate on why firms prefer to report the securitization of receivables as a sale.

Step by Step Answer:

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

ISBN: 1711

9th Edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw