In June 2021 Great Southern Ltd built a submarine under a contract with the Australian Navy. The

Question:

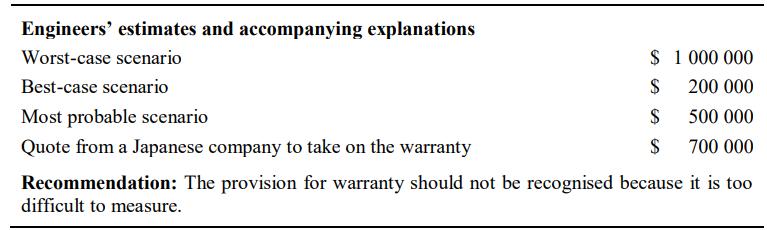

In June 2021 Great Southern Ltd built a submarine under a contract with the Australian Navy. The contract required Great Southern Ltd to provide a one-year warranty. The accountant was unsure how to measure the warranty because the design of the submarine differed from those previously built by Great Southern Ltd. The trainee accountant was asked to obtain more information, so she asked some engineers for their advice on the expected cost of servicing the warranty. The trainee’s report is summarised below.

The accountant needs to decide whether to recognise a provision for warranty and, if so, how to measure it.

Required

1. Describe two principles from AASB 137/IAS 37 that are relevant to the accountant’s decision.

2. Use the principles identified in 1, above, to evaluate the trainee accountant’s recommendation.

3. Describe an accounting policy to account for the provision for warranty.

4. Explain how the policy that you proposed in 3 above, is consistent with AASB 137/IAS 37.

5. Identify assumptions made in the exercise of judgement in proposing an accounting policy for the warranty.

Step by Step Answer:

Financial Reporting

ISBN: 9780730396413

4th Edition

Authors: Janice Loftus, Ken Leo, Sorin Daniliuc, Belinda Luke, Hong Nee Ang, Mike Bradbury, Dean Hanlon, Noel Boys, Karyn Byrnes