Question:

E11.7. Analysis of Profitability: The Coca-Cola Company (Easy) Here is a reformulated income statement for the Coca-Cola Company for 2007 (in millions): Sales Cost of sales Gross margin Advertising expone General and administrative experses Other expenses (net) $28,857 10,406 18,451 2,800 8.145 _81 Operating income from sales (before) 7,425 Tzxx 1972 Operating income from sales (after tax) 5,453 Equity income from botting subsidiaries (after) 658 Operating income 6,12 Net Financial expense aftertas 340 Earnings $5,981

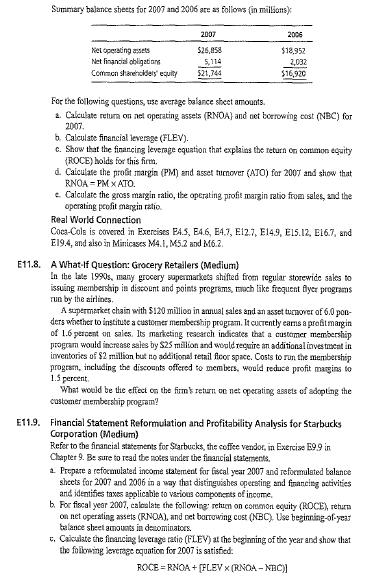

Summary balance sheets for 2007 and 2006 are as follows (in millions) 2007 2006 Net operating assets $26,958 $18,952 Net financial obligations 5,114 2,032 Common shareholders' equity 521,744 $16,920 For the following questions, use average balance sheet amounts.

Summary balance sheets for 2007 and 2006 are as follows (in millions) 2007 2006 Net operating assets $26,958 $18,952 Net financial obligations 5,114 2,032 Common shareholders' equity 521,744 $16,920 For the following questions, use average balance sheet amounts.

a. Calculate return on net operating assets (RNOA) and net borrowing cost (NBC) for 2007.

b. Calculate financial levemge (FLEV).

c. Show that the financing leverage equation that explains the return on common equity (ROCE) holds for this firm.

d. Calculate the profit margin (PM) and asset turnover (ATO) for 2007 and show that RNOA-PMX ATO. Calculate the gross margin ratio, the operating profit margin ratio from sales, and the operating profit margin ratio. Real World Connection Coca-Cola is covered in Exercises E4.5, E4.6, E4.7, E12.7, E14.9, E15.12, E16.7, and E19.4, and also in Minicases M4.1, M5.2 and M6.2.

Transcribed Image Text:

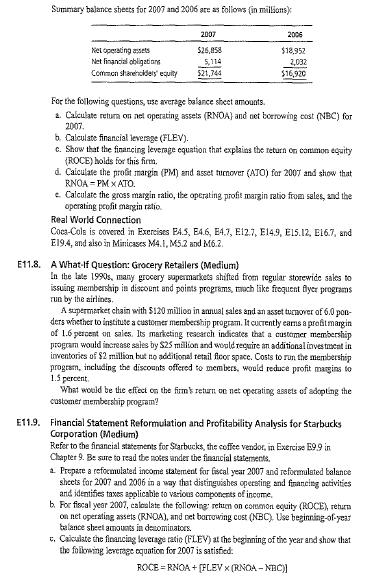

Summary balance sheets for 2007 and 2006 are as follows (in millions) 2007 2006 Net operating assets $26,958 $18,952 Net financial obligations 5,114 2,032 Common shareholders' equity 521,744 $16,920 For the following questions, use average balance sheet amounts. a. Calculate return on net operating assets (RNOA) and net borrowing cost (NBC) for 2007. b. Calculate financial levemge (FLEV). c. Show that the financing leverage equation that explains the return on common equity (ROCE) holds for this firm. d. Calculate the profit margin (PM) and asset turnover (ATO) for 2007 and show that RNOA-PMX ATO. Calculate the gross margin ratio, the operating profit margin ratio from sales, and the operating profit margin ratio. Real World Connection Coca-Cola is covered in Exercises E4.5, E4.6, E4.7, E12.7, E14.9, E15.12, E16.7, and E19.4, and also in Minicases M4.1, M5.2 and M6.2. E11.8. A What-If Question: Grocery Retailers (Medium) In the late 1990s, many grocery supermarkets shifted from regular storewide sales to issuing membership in discount and points programs, much like frequent flyer programs run by the airlines. A supermarket chain with $120 million in annual sales and an asset turnover of 6.0 pon- ders whether to institute a customer membership program. It currently earns a profit margin of 1.6 percent on sales. Its marketing research indicates that a customer membership program would increase sales by $25 million and would require an additional investment in inventories of $2 million but no additional retail floor space. Costs to run the membership program, including the discounts offered to members, would reduce profit margins to 1.5 percent What would be the effect on the firm's return on net operating assets of adopting the customer membership program? E11.9. Financial Statement Reformulation and Profitability Analysis for Starbucks Corporation (Medium) Refer to the financial statements for Starbucks, the coffee vendor, in Exercise E9.9 in Chapter 9. Be sure to read the notes under the financial statements. a. Prepare a reformulated income statement for fiscal year 2007 and reformulated balance sheets for 2007 and 2006 in a way that distinguishes opeesting and financing activities and identifies taxes applicable to various components of income. b. For fiscal year 2007, calculate the following return on common equity (ROCE), return on net operating assets (RNOA), and net borrowing cost (NBC). Use beginning-of-year balance sheet amounts in denominators. c. Calculate the financing leverage ratio (FLEV) at the beginning of the year and show that the following leverage equation for 2007 is satisfied. ROCE=RNOA+[FLEV x (RNOA - NBC)]

Summary balance sheets for 2007 and 2006 are as follows (in millions) 2007 2006 Net operating assets $26,958 $18,952 Net financial obligations 5,114 2,032 Common shareholders' equity 521,744 $16,920 For the following questions, use average balance sheet amounts.

Summary balance sheets for 2007 and 2006 are as follows (in millions) 2007 2006 Net operating assets $26,958 $18,952 Net financial obligations 5,114 2,032 Common shareholders' equity 521,744 $16,920 For the following questions, use average balance sheet amounts.