A bond portfolio manager needs to raise 10,000,000 in cash to cover outflows in the portfolio she

Question:

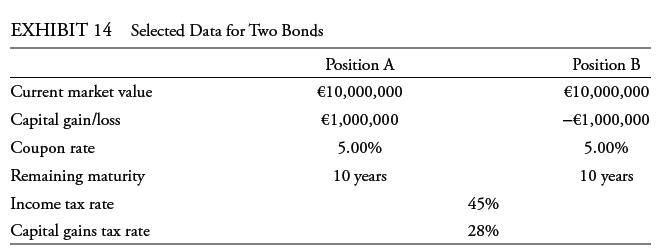

A bond portfolio manager needs to raise €10,000,000 in cash to cover outflows in the portfolio she manages. To satisfy her cash demands, she considers one of two corporate bond positions for potential liquidation: Position A and Position B. For tax purposes, capital gains receive pass-through treatment; realized net capital gains in the underlying securities of a fund are treated as if distributed to investors in the year that they arise. Assume that the capital gains tax rate is 28% and the income tax rate for interest is 45%. Exhibit 14 provides relevant data for the two bond positions.

The portfolio manager considers Position A to be slightly overvalued and Position B to be slightly undervalued. Assume that the two bond positions are identical with regard to all other relevant characteristics. How should the portfolio manager optimally liquidate bond positions if she manages the portfolio for:

1. Tax-exempt investors?

2. Taxable investors?

Step by Step Answer: