A fall in interest rates would most likely result in: A. A decrease in the effective duration

Question:

A fall in interest rates would most likely result in:

A. A decrease in the effective duration of Bond #3.

B. Bond #3 having more upside potential than Bond #2.

C. A change in the effective convexity of Bond #3 from positive to negative.

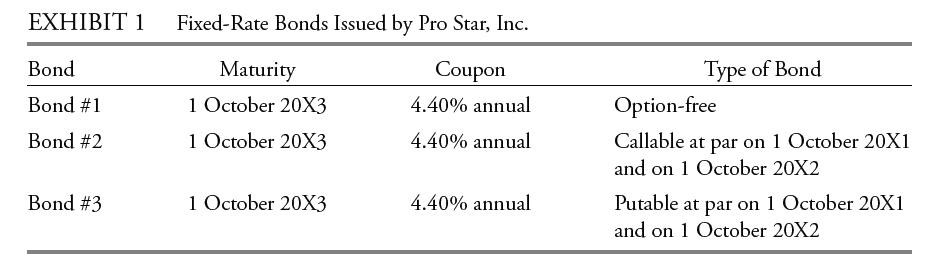

Samuel & Sons is a fixed-income specialty firm that offers advisory services to investment management companies. On 1 October 20X0, Steele Ferguson, a senior analyst at Samuel, is reviewing three fixed-rate bonds issued by a local firm, Pro Star, Inc. The three bonds, whose characteristics are given in Exhibit 1, carry the highest credit rating.

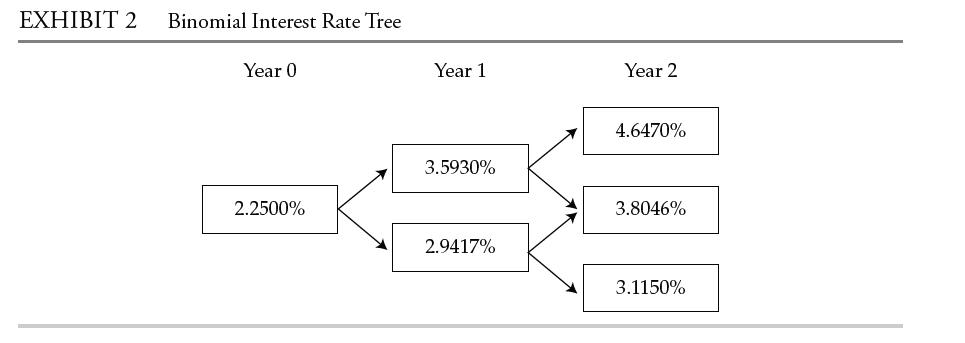

The one-year, two-year, and three-year par rates are 2.250%, 2.750%, and 3.100%, respectively. Based on an estimated interest rate volatility of 10%, Ferguson constructs the binomial interest rate tree shown in Exhibit 2.

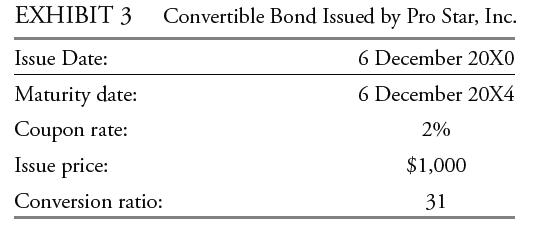

On 19 October 20X0, Ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the option-free value of Pro Star’s convertible bond is $1,060 and its stock price $37.50.

Step by Step Answer: